Infinite exponential growth in a finite system is the ideology of cancer cells and viruses, and it kills the host.

Growth is the name of the economic game: it is the goal every corporation and government strives to reach. You will hear about it everywhere, it is discussed constantly. But why must we endlessly grow, especially when our growth is clearly killing the planet? The drive for growth is not just a goal, our economic and monetary systems are designed for infinite exponential growth, it is required or else those systems collapse. We are trapped by this growth imperative, and if we do not transition into a sustainable circular economy it will cause ecological collapse.

Neoliberalism

My platform includes this term quite often because it has become the dominant ideology across the global economy and is what informs and justifies the unsustainable infinite growth economy. It is slowly becoming more known to the public, but the term is still relatively obscure.

What is neoliberalism?

Neoliberalism is the idea that the “free” market is the ultimate decider of the economy, that governments and their influence should be minimized as much as possible, and anything that can garner private profits should be left to the private sector. I put “free” in quotes because there is no “free” market, it is gamed on all sides, whether by supranational corporations or by government intervention.

Most people see the purpose of education and healthcare as enlightening people with knowledge and keeping them healthy and long-lived. A neoliberal sees the purpose of education and healthcare as maintaining a competent and reliable workforce. Most people see the government as a provider of services to help and support the public, a neoliberal sees the government as a facilitator of corporate profits or an impediment to them. To a neoliberal, people are merely a labour force for the owners of capital to extract profits from. We are but numbers on their ledger sheet.

The history of neoliberal policies

Neoliberalism gained prominence after our last inflationary period in the 70s, inflation triggered by the OPEC oil crisis that many nations then spent the next decade struggling to contain. I wrote about Canada’s experience with it here, and most Western nations had similar histories.

After the unprecedented growth and prosperity of the post-war period, by the early 70s unions had gained great power and influence, income inequality was much lower, and people were exercising their democratic rights more than ever. This was not good for the profits of the elite, or their ability to command the economy. When inflation refused to be tamed, Canada’s first step into neoliberalism was to institute wage and price controls. Wages have not grown with productivity since that time.

Then came the neoliberal wave, a triple blow of neoliberal leaders all instituting the same free market polices at once: Thatcher in the UK, Reagan in the US, and Mulroney in Canada. They began privatizations of government assets and companies in earnest, they made it harder for unions to operate, and they deregulated many things, especially in financial markets. This neoliberal trend is what has led to the volatility of finance over the last 30 years, not to mention greater income inequality, rising home prices, and low wage growth.

Neoliberal ideology

One of the most pervasive neoliberal myths to justify privatizations and reduced government is that the private sector is more efficient. This myth is so ingrained many people take it as gospel, it is just an accepted truth. Yet nothing could be further from the truth.

At best the private sector is just as efficient as the public sector, at worst it costs more, pays lower wages, and cuts corners. Studies have shown this, and Ontario’s experience with P3s (public-private partnerships) shows how lousy they have been. If the public sector is doing a lousy job it is only because politicians are sabotaging it in order to justify privatization.

The connection of neoliberal ideology to policies across the globe is not theoretical, neoliberalism is what underlies any post-secondary education in business or finance. Anyone taking an MBA is learning how to maximize profits by minimizing costs, whether it is externalizing environmental costs by moving polluting manufacturing to a poorer country with lax environmental laws, or slashing thousands of jobs to move them overseas to cheaper labour. Neoliberalism is the cutthroat logic behind the decisions of finance and Big Business, and we are all suffering under it.

If we do not start exposing this ideology and resisting it, it will become our downfall. Neoliberalism normalizes and lauds selfishness and greed as positive traits that make the world go round, the psychopathic notion that if everyone just behaves selfishly the resulting economy will provide for all needs. After almost 40 years we have seen this simply is not true. It is time we discard an ideology by the elite for the elite and transition into something truly equitable and sustainable.

The Infinite Growth Economy

I had written about our monetary system in my last platform, now I will briefly get into how it ties in to the growth economy. The best analogy is to think of the economy as a car with no brakes and no reverse, it can only go forward or crash.

Growth is imperative

It is not an opinion or theory that our economic and monetary systems require infinite exponential growth or they collapse, that flaw is built into those systems and it’s incompatible with a sustainable circular economy. It is because of two things combined: the fact our monetary system is entirely based on debt, and because that debt is mostly charging compound interest.

The monetary system requires growth

Most of the money in our economy is created by private banks as debt. If money is the lifeblood of the economy, private banks are the heart pumping it through. Whenever you take a loan, a line of credit, a mortgage, or use your credit card, your bank is creating brand new money on the spot. This new money is matched by the new debt.

Because these loans are what buy homes, start or expand businesses, and purchase goods and services, most of the money currently in the economy is a debt that needs to be paid back. It is paid back with more money from new debts. Money circulates in the economy by new debts paying off old debts, in a never-ending cycle of debt. So without constant growth to justify taking on new debt, there will be no money to pay off old debts, and the whole thing comes crashing down.

The exponential requirement of the growth is due to compound interest. Because almost all interest charged is compounding, that means the growth in the debt is exponential, meaning to repay the debt one’s income must grow exponentially as well. Think of interest rates as the gas pedal on the speed of the economic growth engine: you lower the interest rate pedal to move faster, you let up on the pedal to slow things down. But make no mistake, there is no stopping.

Federal finance

There is one exception to this: the federal government. Because Canada is monetarily sovereign, meaning we own and control our central bank and have our own sovereign currency, the federal government can create and spend as much money as it pleases without limit. It also does this by creating debt in the form of bonds and t-bills, but through the magic of monetary financing the Bank of Canada is able to hold our debt so the interest is not owed to banks and investors. This is why it is a clear-cut lie when any federal politician claims, “We don’t have the money”, like when Trudeau lied to veterans that the feds could not support them more.

COVID proved to all Canadians that the feds can turn on the money taps in unlimited amounts anytime they want. CERB proved the fiction that the federal government is monetarily constrained. The only thing in the way of the federal government spending more equitably is neoliberal ideology.

This is why in my last platform I called for Toronto to have its own public bank. However with the advent of digital currencies I now realize there is a simpler way than creating a bank, especially as that bank would have to use the Canadian dollar and be subject to all the charter requirements of a bank and therefore could not truly function as a central bank for Toronto. What we need is a digital currency just for Toronto, a TO dollar.

Population Growth

The most short-sighted part of our growth economy and development policy is not even that it is furthering environmental destruction and adding many tonnes of emissions to worsen climate change, it is that it assumes our population will just keep growing forever, completely ignoring population trends around the globe.

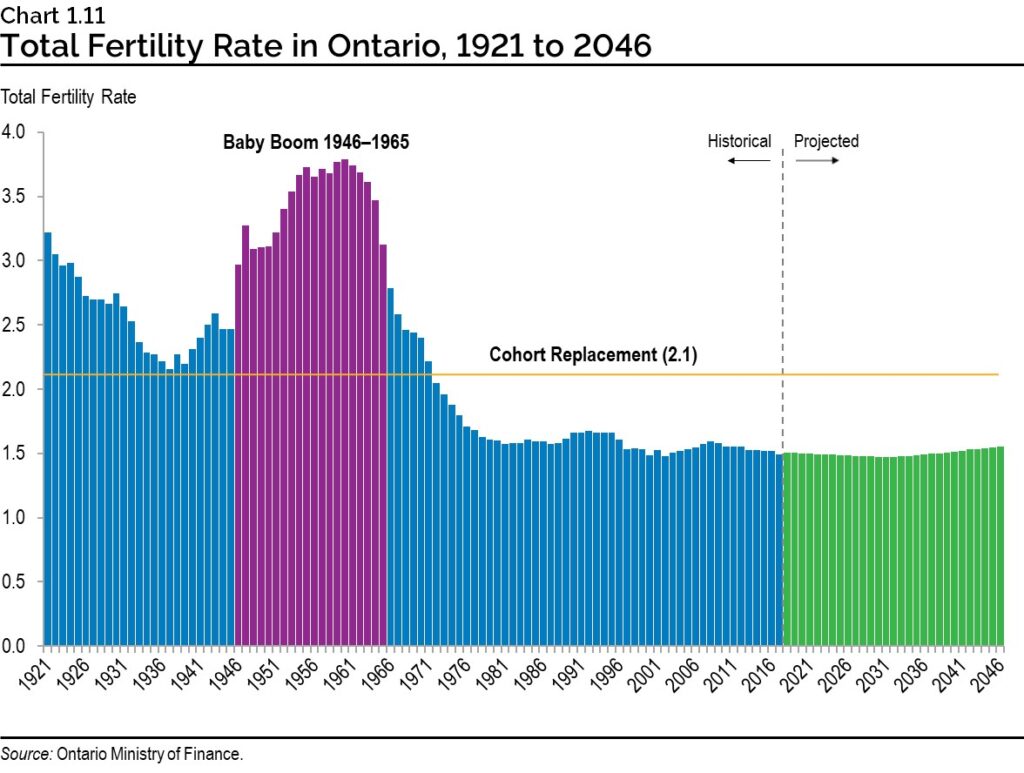

Domestic fertility rates

When governments talk about population “growth” it is a bit of a misnomer, it makes it sound like the natural growth from our residents’ procreation. Our population is not growing, it is being added to through immigration.

Fertility rates all across Canada, and especially Ontario, have been declining for decades, ever since the end of the post-war period and the Baby Boom. During that time of unprecedented growth the corporate sector got too accustomed to such growth, so when it naturally ebbed and secular stagnation (a natural slowing of the economy) and a profitability crisis (when businesses are not earning enough to cover their debts) set in, they found new ways to keep the profit machine turning, primarily through wage suppression and immigration.

Immigration

If it were not for immigration we would be depopulating soon. Our fertility rates have been below replacement value since the 70s. According to the province “In the 1970s, about one-third of population growth was coming from net migration and two-thirds from natural increase. The situation has reversed. Over the last 10 years, natural increase accounted for 28 per cent of population growth in Ontario, and net migration for 72 per cent.”

This means our “growth” is not natural, it is a policy choice. So when the government says we MUST keep adding housing to accommodate growth, that growth is not some inevitable natural trend, it is the government imposing growth on us to sustain the growth economy and the corporate profits it feeds.

If we are so behind on the infrastructure and housing to absorb that growth all the federal government need do is turn down the immigration taps a little to give us time to catch up. But doing so would not feed the exponential growth our system requires, so they keep the taps open as much as possible, no matter how much it is destroying the environment and making our city less livable.

Feeding developers’ profits

And developers and real estate investors bank on immigration growth to fill their units. The staunchly neoliberal elite-oriented pro-corporate Globe & Mail reveals this dynamic in a few articles:

“However, a sharp reduction in the number of newcomers to Canada, fuelled by the pandemic, has been a headwind this year. In major cities such as Toronto, dwindling numbers of international students have hit condo unit prices, and rents have been falling, especially for newly constructed apartment buildings.

“Remedying this, the federal government has already pledged to significantly boost immigration levels, with the goal of bringing in 1.2-million newcomers over the next three years – a move that satisfies many institutional real-estate buyers who have ample capital to think in years, not months. “Investors in apartment properties are looking through 2020 and 2021,” Minto’s Mr. Dixon said.” link

“The fundamentals for housing demand are still strong, he said, in part because Canada is targeting a record intake of permanent residents in the coming years.” link

This exposes the truth about immigration and development: it is not about meeting the housing needs of our residents, it is all about meeting the profit lust of developers and investors. Developers are not creating new housing to meet the needs of new immigrants, rather the federal government is bringing in new immigrants to meet the profit needs of investors and developers and their “ample capital” seeking a return. Too many housing advocates seem duped by the propaganda that development is about affordable housing, it is not, it is about corporate profits, like most government policies.

Ignoring population trends

These development policies are not just short-sighted because of their environmental impacts and the strain density is adding to our city. They seem to completely ignore local and global population trends too, as if we do not have the largest age cohort in history all coming to the end of their lives, and as if there will always be an endless supply of people to import.

The Boomers aging also means new housing supply opening up as they move into seniors’ residences or pass away, which is happening at a faster and faster pace. But nothing in housing policy seems to take this into account, or it does simply by assuming we can always just increase immigration to make up the difference.

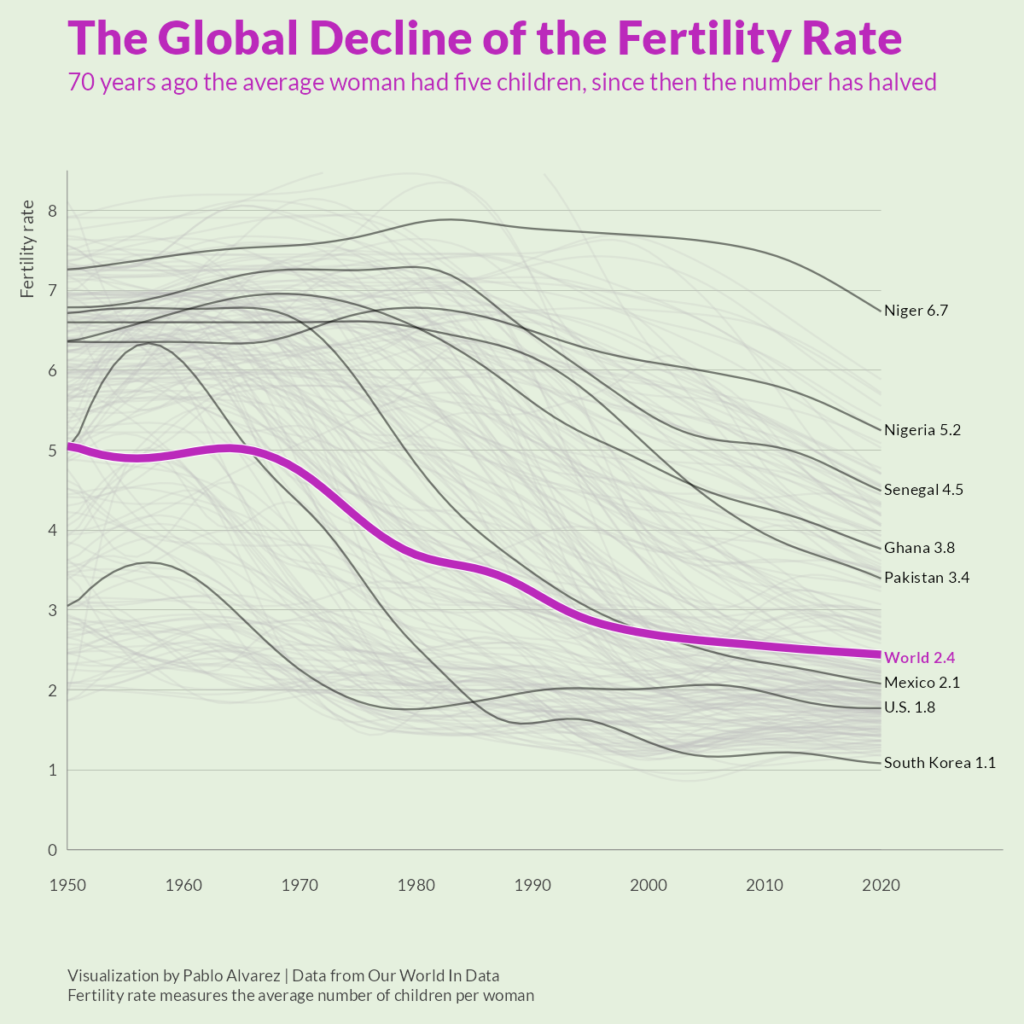

Global fertility rates

The decline in fertility rates is not just in Ontario and Canada, it is across the globe. Replacement value is 2.1, globally the fertility rate is only 2.4. This has a few implications for immigration. First of all, EVERY economy across the globe is based on growth, every economy and their banking system are intertwined and all require infinite exponential growth or they collapse. Which means every economy with a fertility rate below replacement value (which is every Western economy) will be competing for immigrants to fill the void. What happens if other nations offer better incentives to immigrants and we have trouble competing?

More importantly, the nations with higher fertility rates are also growth economies, and need their population to grow as well. What happens when developing nations, historically the main source of our immigrants, see their fertility rates dropping and for the sake of their own growth start incentivizing their residents to stay?

There are other ironies at play here, like the aid we give to developing countries and how expensive we have made it for new families in our own country. The main reasons for declining birth rates are women’s empowerment, particularly in education and the workforce, lower child mortality, and increased cost to raising children. So the more we help other nations develop and improve their education and child mortality, while we continue making things more expensive for our own families, the fewer children there will be to feed population growth for any nation.

Population projections

Canada and organizations like the UN predict population growth will slow, but not stop, and of course they have to predict that, because it justifies their infinite growth economic policies. But is that a fair prediction? Other studies paint a different picture, that at current rates our population will peak mid-century and steadily decline by the end of the century.

The rosy picture painted by the powers that be may be rosy simply because they originate from the powers that be, elites who are completely out of touch with the on-the-ground reality most people struggle with. What happens to the urge to have children in an increasingly depressing world, where climate change looms, the middle class is shrinking, and the elderly will outnumber the young?

Limits to growth

It is only natural the human population will not grow forever; every species has a natural ebb and flow in its population. No species just grows forever without hitting ecological limits, and we are hitting the limits to our growth with our destruction of the planet and climate change. Humans fancy ourselves outside of nature, and many techno-optimists believe we can just keep trucking along because some fantastical technology yet to be invented will come along and save the day.

If we keep devoting our resources and emissions to feeding the growth economy, instead of using them to protect ourselves from the coming challenges of climate change and to create a resilient, sustainable, circular economy, we will meet with disaster when decades from now our lack of food security ends up causing food riots and civilization as we know it dissolves. We not only must transition out of the growth economy, we must also consider degrowth to reduce the impacts we are currently having.