There is an intentional imbalance in every monetary system, it is intertwined with the capitalist economic system and pushes it forward, and this imbalance is a direct reflection of the imbalance inside the people that devise and maintain the system that controls us all.

When banks make a loan of any kind, whether for a business loan, mortgage, credit card, or line of credit, they are creating new money right then and there. Loans create money, repaying loans deletes money.

The vast majority of money in the economy is created by banks when they lend. When the bank gives you a loan you get an new asset (the money) matched equally with a new liability (the loan). However, what is not matched on both sides of the balance sheet is the interest the loan has on it. The money to pay the interest does not exist in the system, the system must constantly expand over time to cover the payment of interest.

The fact the money to pay the interest is not created along with the loan, leaving a constant imbalance in the system, is the core aspect of the monetary system that drives the growth economy. New debts pay off old debts in a never-ending spiral (it truly is a Ponzi scheme), but what allows for the continued expansion of all that is the continued expansion of the population and resource extraction. New people and new resources from which wealth can be extracted means new debts can be created at a level capable of paying off old debts.

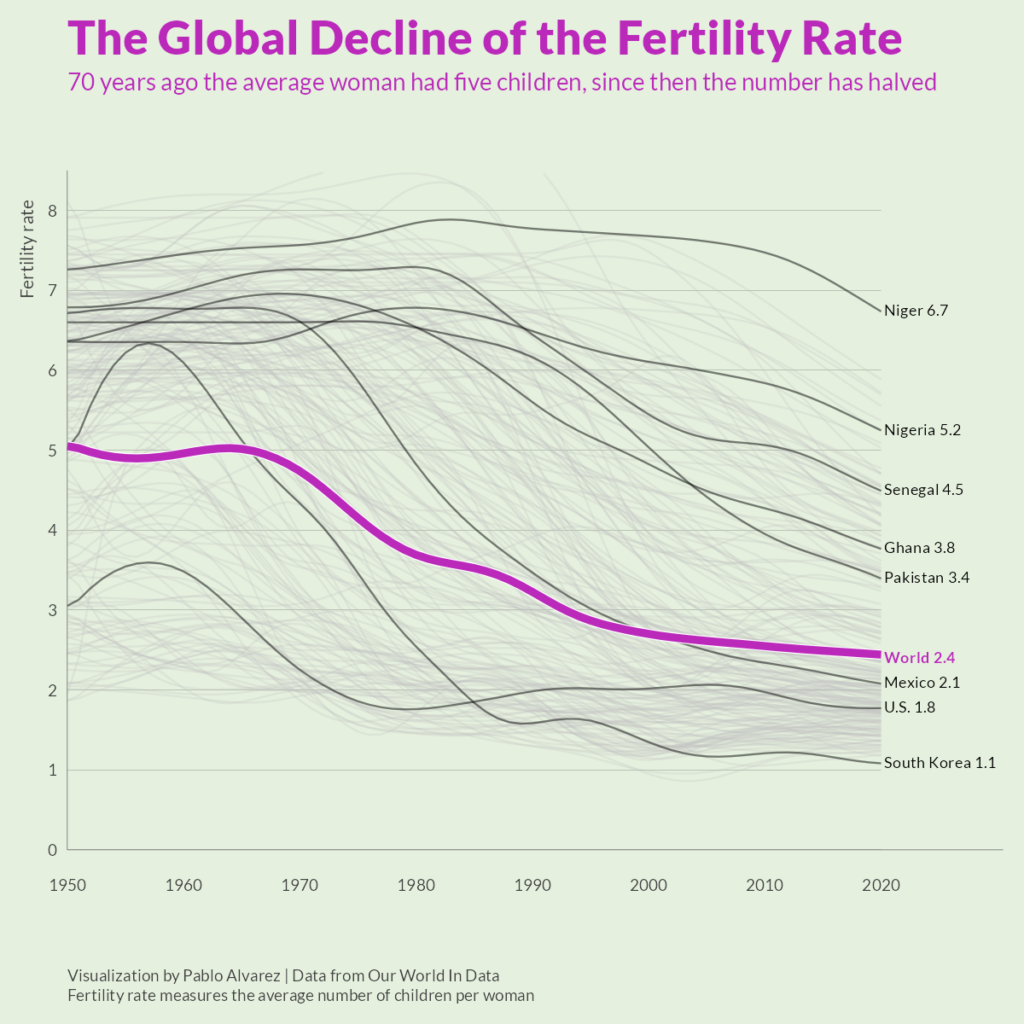

But if growth slows down for any reason, like the global birth rate leveling off the last 40 years, or a natural disaster, or because people are consuming less to have less of an impact on the planet, or because consumers are so over-indebted they simply can’t afford new stuff, the whole house of cards comes crashing down. Such is the folly of a debt-based monetary system, especially one that uses compound interest, because then the economic growth must also be exponential to overcome the exponentially growing debt.

This is not the first time in recent history we’ve started bumping up against the limits of such an unsustainable system. The last time was during the profitability crisis of the late 60s/early 70s (here’s an excellent US perspective that also traces the roots of neoliberalism). A profitability crisis ensues when corporations aren’t pulling in enough revenue to cover all their debts potentially leading to insolvency, and avoiding such a “crisis” is why the federal government’s primary concern is feeding the corporate profit machine.

Due to high public expectations and in part to strengthening unions, workers had been making serious gains in the post-war period, taking a larger and larger share of the wealth created in the economy and leaving less for the owners of capital. This was the golden age of capitalism into which the Boomers were born, and all that growth also required alot of progressive investments by government, like new hospitals and schools, and as the Boomers aged, new universities too. This was all well and good as long as the unprecedented economic growth of the post-war period kept on chugging.

But the debt-based monetary system requires EXPONENTIAL growth, it wasn’t even a matter of keeping pace with previous years, the economy was required to somehow grow FASTER. Except by the late 60s/early 70s “secular stagnation” was setting in, a completely natural ebb of economic growth. But the system was not designed to ebb; it was designed to be an ever increasing flow upwards into the pockets of the wealthy elite.

So, what was the reaction of capital to the profitability crisis resulting from this natural and unavoidable secular stagnation? Well that was the birth of “neoliberalism”, an ideology hell bent on turning EVERYTHING into a marketable commodity in a “free” market that was to be influenced as little as possible by government.

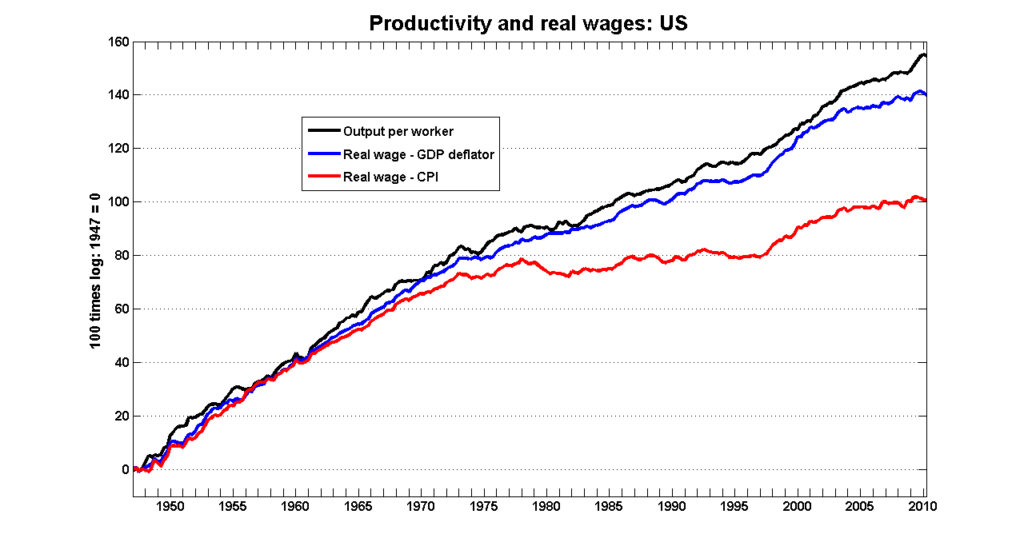

The OPEC oil crisis hit (1973), inflation soared, and the elite saw an opportunity in the crisis to regain the power they had before WWII. Wage and price controls were instituted in the US and Canada, and you can see on a chart how from that point (1975) onward productivity kept going up while wages have completely stagnated.

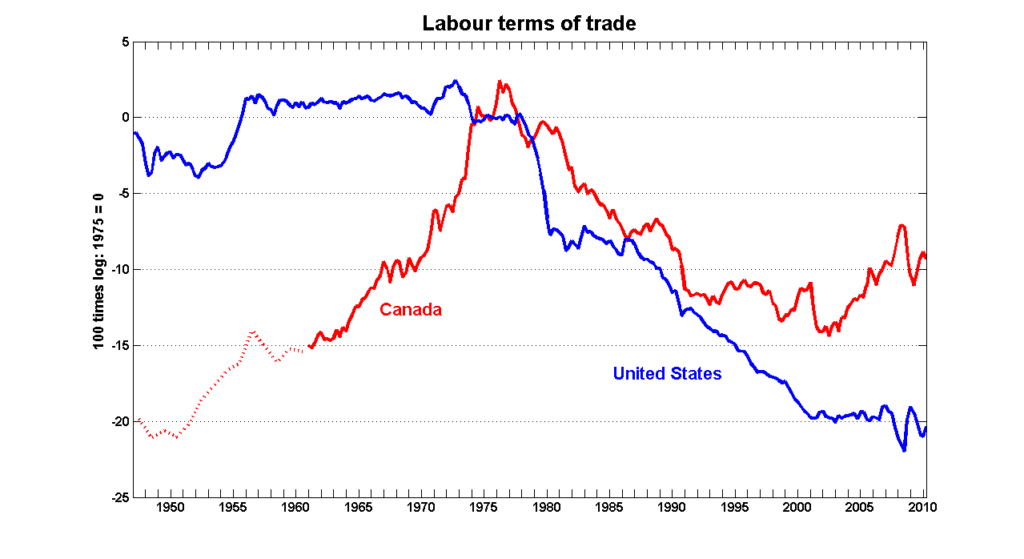

Another way to look at it is labour terms of trade:

Which is why since 1975 the incomes of the wealthy elite have gone up so much more quickly than workers: as the pie expands labour’s slice remains the same size. In the post-war period labour gained too much share of the profits, the elite had to regain their lion’s share.

The “free” market fetish at the core of neoliberalism also entails circumscribing government by actively and openly advocating for retrenchment, regardless of how socially destructive austerity has proven. This has taken many forms over the last 40 years, from demonizing and restricting deficit spending, to privatization after privatization of public assets, to trade agreements that are little more than corporate power agreements, to the rise of public-private partnerships, to simply slashing and burning the public service (like the 25% across-the-board cuts of Chrétien in the 90s).

In a neoliberal context, government’s only priority is to facilitate the profits of the private sector, THAT is government’s only purpose: providing a stable labour force and maintaining a profitable environment for our largest corporations (and by extension maintaining the wealth and power of the elite). Education is not about enriching lives and enlightening minds, it’s about training a competent workforce. Healthcare is not about keeping people well, it’s about maintaining a healthy and reliable workforce. All of the seemingly benevolent bandaids and handouts dribbled out by government are designed to be just enough to stop people rioting over the problem, but never enough to solve anything.

Turn to today, with growth slowing the last decade in another bout of incurable secular stagnation that rock bottom interest rates cannot stimulate, what have all the big banks and companies been doing to keep the debt machine chugging? Well if the real (physical) economy can’t provide the growth they need, they turn to shadow banking and the speculation of the global casino of financial markets, markets which have become completely unhinged from reality.

The irony is that now investments in completely virtual financial products are considered “less risky” than investments in actual physical ventures, because something physical has to work in reality to succeed, but if it only exists in the virtual realm they don’t have to worry about reality getting in the way. That was the root of the 08/09 GFC, too many entities desperate for investment earnings went after what looked like a sure thing on paper, when it had zero connection to the reality crumbling beneath it. Once reality caught up with the paper, it all came crashing down.

Speaking of mortgages, the other solution for the elite having too much money and not enough places to grow it is to put it into physical assets, like real estate, bidding up the prices to incredibly inflated highs in desired areas. This is why housing has gone through the roof in some markets, because of the amount of speculation. Worst are not the house flippers, but investors who have so much money they simply sit on vacant homes for years waiting for the need to sell.

Between tax avoidance and ever-lowering corporate tax rates the wealthy elite have managed to keep their profits rolling in at the desired pace, but that leaves the remaining burden of debt on governments, and we’re seeing that worldwide. Every government is burdened with debt and starved for revenue because they keep bending over backwards to reduce costs for corporations in order to spur economic growth that never happens. All that happens is the growth of wealth for the elite.

And a portion of that growth in wealth comes from the government bonds that the wealthy and corporations line their investment portfolios with! So instead of taxes removing the need to sell bonds to fund government spending, they cut taxes and sell the bonds to the very entities that use the money they saved from lower taxes to buy the bonds! Imagine that deal if you would:

- government gives wealthy/corporations a tax cut

- now government is short of revenues to spend and so must raise money selling bonds

- government sells bonds to the wealthy/corporations who buy the bonds using their tax savings

- government uses the proceeds from bond sales to spend on the public, but now owes interest to bondholders, interest on money the wealthy/corporations wouldn’t have had to buy the bonds with if they were taxed properly in the first place!

Isn’t it simply diabolical that our governments turn tax cuts into not just a savings for corporations and the wealthy, but then also make an interest-earning investment out of it for them, allowing them to double dip? They get their tax savings, and some interest earnings to boot. Now, if cutting those taxes actually resulted in positive economic results for all they could be justified, but supply-side or “trickle down” economics has been proven unequivocally a failure of neoliberalism. If that doesn’t lay bare the inequity of the system I don’t know what does.

Today we’ve reached the limits of our exponential interest debt-based monetary system and the growth economy. Not just because infinite exponential growth on a planet with finite resources was always an unbalanced equation and our consumption is killing the planet, but because we’re simply coming to a natural plateau as a species.

The global fertility rate is now 2.4, replacement value is 2.1, we aren’t creating enough people to satisfy the growth economy and its pre-existing debt. We need an economic system that is FLEXIBLE, that can ebb and flow with the natural ebb and flow a species should have (no species on the planet save humans expands century after century displacing and extinguishing hundreds of species in its tracks).

I am actively trying to devise such a system, the problem is there’s simply no room for billionaires in a sustainable system. I don’t say that simply because I want a more equitable system or because billionaires are just elite psychopaths (unless you inherited it, you can’t become a billionaire without heartlessly and grossly exploiting masses of people). I say it because the ability of the billionaire to extract that much wealth, and their ability to command the resources that wealth buys, is too large an imbalance, their wealth extraction and resource consumption doesn’t leave room for a sustainable circular economy. The planet simply doesn’t have room for psychopath billionaires.

In the end, bad debts can be written off, companies and people can go bankrupt, but that’s not a reset or even a bandage. It’s a peek at the truth: that our neoliberal capitalist system is one of exploitation of the masses by the elite, a wealth vacuum for the ultra-rich. Yes, regular folk get some benefits from that system too, but that’s just to keep them happy and distracted and not straying from their role as labour creating wealth for capital. Not to mention those benefits for regular folk have been shrinking ever since neoliberalism set in, the gains by labour of the post-war period are being eroded, there are more renters and less owners of property, and you can see on a chart how the middle class is shrinking. We’re slowly returning to feudalism.

Here’s the kicker:

My concrete conclusion after years of studying the history of politics and economics through the lens of psychology is that we are ruled in all corners by textbook non-violent elite psychopaths. The Stephen Harpers, Rob/Doug Fords, and Donald Trumps of this world are a prime example. And if the person in charge is not themselves a psychopath (as I believe Trudeau is not), it’s only because they’re the puppet of billionaire psychopaths (like the Bronfman family that run the Liberal Party). Really, you can look at just about ANY leadership across the world, whether political or business, and you find psychopaths dominating. That’s why supranational corporations behave like psychopaths: it’s just a reflection of the people running the show.

If you want to reach the end of the rabbit hole, the unifying theory that explains ALL the evil and inequity in the world, read about psychopaths. Not all psychopaths are evil, but directly or indirectly all evils started with a psychopath. Here’s a few books on the topic should this pique your interest:

Political Ponerology by Andrzej Łobaczewski

The Wisdom of Psychopaths by Kevin Dutton

Without Conscience by Robert Hare

The Psychopath Test by Jon Ronson

Snakes in Suits by Robert Hare and Paul Babiak

How did talking about interest rates evolve into a diatribe about psychopaths you might ask? It actually gets to the heart of the system, the WHY. Why would we use a monetary system that is inherently unbalanced and unsustainable, requiring impossible infinite growth on a finite planet, in a globalized era of modern technology and instant communication, when we know for a fact we are pushing against the ecological limits of our growth as a species? Are bankers, economists, and politicians all really that short-sighted, or, just like the behaviour of corporations, is the structure of our monetary and economic system just a reflection of the psychopaths running it?

Psychopaths do not feel emotions as regular people do, they have a bottomless black hole where there emotions should be. Imagine if you can, knowing an emotion in your head, like happiness, sadness, guilt or remorse, but not feeling it in your body (which is why we call them “feelings” in the first place, we actually have a physical reaction to emotions we can feel in our gut). Psychopaths spend their lives trying to fill this hole, but it’s unfillable, they stuff more and more into the hole with no effect, the hole is still empty. But they can’t simply stop trying to fill the hole; everyone with a hole in their life tries to fill it. Some unfortunate people without support try and fill that hole with booze or drugs, whereas many folk often find a hole in their life filled by family, friends, community, or religion, unlike psychopaths, whose hole is simply unfillable, they are insatiable.

This bottomless black hole where their feelings should be is what drives psychopaths to risky behaviour. In striving to feel something, anything, the closest they can get is adrenaline and/or dopamine, and so they seek out risky and/or pleasurable behaviour. They are also incredibly charming and manipulative and gravitate towards positions of power. The saying “power corrupts” is a specious truism few question, despite the fact it’s a complete myth. Power does not corrupt, the corrupt seek power. Everywhere there is a position of power, you can bet there’s a psychopath vying for it, it’s one of the many ways they try in vain to fill that unfillable black hole.

And THAT is why the system is paradoxically based on infinite exponential growth in a finite system: it’s a direct reflection of the unfillable black hole existing in the elite psychopaths running the system. The system is built by psychopaths for psychopaths, ever since we left behind our hunter-gatherer ways for civilization psychopaths have been gaming things in their favour and taking and consolidating power every chance they get.

In a lot of ways civilization itself facilitates psychopathy, and in all likelihood was started by a psychopath hoarding fertile land and exploiting others to labour for their benefit. It’s really hard for a psychopath to selfishly exploit and monopolize in a hunter-gatherer group where the group’s survival depends on group cooperation and everyone knows everyone intimately. But in a city of millions, where you can back stab and climb your way to the top leaving destruction in your wake with impunity, psychopaths find themselves right at home.

Regular folk have little chance against psychopaths, the system is designed by them for them, and the ONLY way to rise to the top is to either be a ruthless psychopath or be willing to act like one to compete with all the other elite psychopaths. I know a few people high up in corporations who just couldn’t hack it anymore because of their psychopathic bosses and the psychopathic decisions they were forced to make.

One fellow in particular, who was a highly paid corporate executive who was slowly eating and drinking himself to death, had to quit after his boss was telling him to fire people for reasons that made a little sense in the short term (to save money) but no sense in the long term (because half the sales team would be gone before their usual clients were buying in). Classic psychopathic behaviour: seeking immediate reward regardless of long term consequences.

EVERYTHING about the structure of our system is rooted in the need for elite psychopaths to constantly fill their unfillable hole. Missing their emotions means psychopaths are inherently unbalanced by nature, hence the system they designed being inherently unbalanced by nature. And we’re all being dragged along for the ride. I for one would like to get off the psychopath’s treadmill and walk at my own pace, instead of the pace set by the endless hunger of an emotionless bottomless black pit.

By Adam Smith, 21st Century