As a supplement to my article “What About the Grandchildren? Dealing with Debt from COVID” I have made a list of mainstream media articles that either take the neoliberal line and foment unnecessary and ignorant hysteria over the federal debt and/or deficit, or those that state the actual reality of debt and deficits being a necessary investment in the public and no burden to the government or the public. In some cases it’s not the article itself taking a stance, but the politicians being reported on. You will note what type of more neutral balanced publications state the truth (ie Star, G&M, CBC), and the rabidly right-wing articles that propagate fear based on myths (Financial Post).

Those that got it right (mostly):

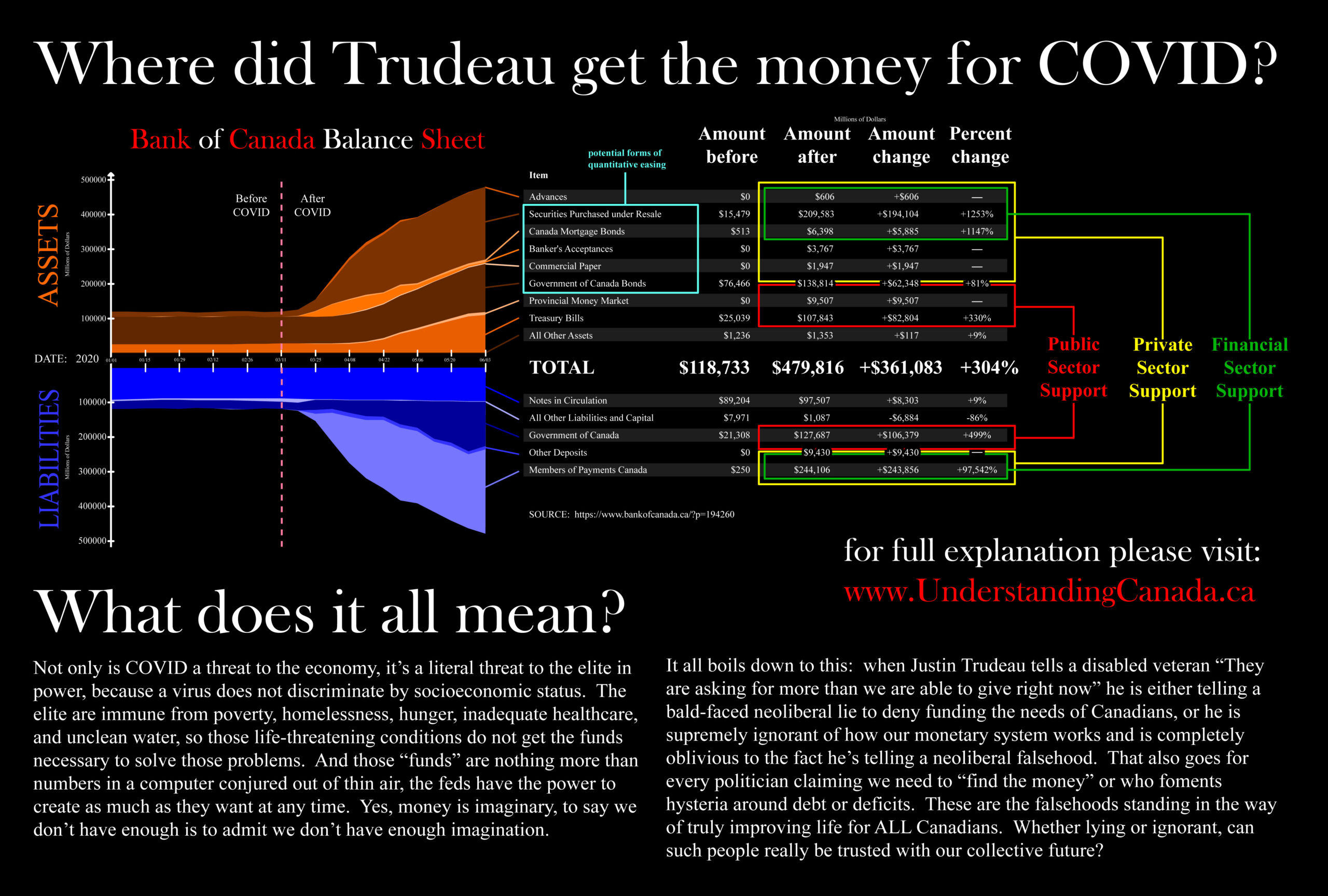

I have been VERY encouraged by some of the mainstream media coverage of COVID federal deficit spending and the debt it incurred, and even more so that Modern Monetary Theory (MMT) is coming into the public’s lexicon. People are finally waking up the reality of money being simply a symbol of value that is entirely virtual, and that there is no limit to creating a supply of something virtual. Spending money has limits in the amount of labour and real resources available to be bought, but the money itself is never limited. Here’s a bunch of articles that give me hope the public (and the elite) are slowly giving up on the fictions that constrain us from a more equitable society.

Five reasons it’s time to relax about the Trudeau government’s huge deficit

https://www.thestar.com/business/opinion/2020/10/26/five-reasons-its-time-to-relax-about-the-trudeau-governments-huge-deficit.html

This first link is perhaps the most excellent of all the mainstream media in Canada, written by the amazing Jim Stanford. Talk about cutting through the bullshit, he plainly states the 5 perfect reasons why debts and deficits simply don’t matter. These reasons echo many of mine included in the grandchildren article, the most important to note being #5: Government’s debts are Canadians’ assets.

How is Ottawa going to pay off its COVID-19 debt? With any luck, it won’t have to

https://www.theglobeandmail.com/opinion/editorials/article-how-is-ottawa-going-to-pay-off-its-covid-19-debt-with-any-luck-it/

A great and balanced article from top to bottom, allaying fears with relevant history from past instances of large government intervention.

No need to worry about a deficit when the government can print money, say some economists

https://www.cbc.ca/radio/sunday/no-need-to-worry-about-a-deficit-when-the-government-can-print-money-say-some-economists-1.5594636

I must say I’m proud of how our public broadcaster has fairly and evenly represented MMT in this article, even interviewing Kelton and stating the true reality, “This ability to print money means that Canada will always be able to pay its bills, it can never go broke, or default on its debt, no matter how deep into the red it goes.” Excelsior!

Why Canada Won’t Go Broke

https://thewalrus.ca/why-canada-wont-go-broke/

This is one of those articles that kinda gets it right, but is clearly unfamiliar with MMT and so in the subheading makes the mistake of calling it “controversial”. MMT is not controversial, it’s just how it all works, what’s controversial is that MMT lays bare the lies and distortions and obfuscations of those in power that want the public to believe there is some finite limit to the spending of a monetarily sovereign government. The controversy isn’t over the reality of the monetary system, it is over the challenge to power that public knowledge of this reality brings.

The article also addresses the spectre of deficits from ignorant alarmist conservatives when it mentions, “Conservative senator Leo Housakos accused the prime minister of leading “the greatest country in the world into bankruptcy.”” Such blatant fear mongering over what is actually 100% impossible should be criminal, or at the minimum, should be grounds to removing a senator’s job for life. Thankfully the article immediately debunks this nonsense.

It continues to explain some of the basics of MMT, mentions Kelton and “The Deficit Myth” and generally does a good job of stating the reality as per MMT, and mentioning that the inflation bogeyman is not rearing its head. It then goes on to speak of the detractors, and then mentions the red herring of Venezuela without getting into why those things do not apply, but still goes on to say none of those issues really apply to Canada, and even drops a line, as I have, about MMT poster child Japan.

COVID-19 has proved the value of big government. Will Justin Trudeau step up and lead the economy?

https://www.thestar.com/politics/political-opinion/2020/04/28/covid-19-has-proved-the-value-of-big-government-will-justin-trudeau-step-up-and-lead-the-economy.html

While this article doesn’t exactly mention debt or deficits, it’s a good example of balanced reporting that questions neoliberal assumptions about Big Government all while avoiding the fear mongering.

The throne speech: Fiscal prudes are fretting about the wrong issues

https://theconversation.com/the-throne-speech-fiscal-prudes-are-fretting-about-the-wrong-issues-146010

Considering I just learned that Marc-Andre Pigeon has been a proponent of MMT for 20 years it’s no surprise he gets it all right in this article. He even stays ideologically neutral by commenting about the calls on the left and right of the political spectrum to be misguided and misinformed, and correctly states we’ve got far bigger concerns, like COVID and climate change. This is yet another case, like the Stanford article, where they pretty much could have written my grandchildren article for me. Or put more aptly, we’re all working to the same equitable ends with a thorough knowledge of the reality of the monetary system.

As Canada’s budget deficit soars, where are the tightwads in Justin Trudeau’s cabinet?

https://www.thestar.com/politics/federal/2020/09/13/as-canadas-budget-deficit-soars-where-are-the-tightwads-in-justin-trudeaus-cabinet.html

While this article engages the anonymous deficit hawks in government, the reporting stays even-handed and amply gives the other side of deficit spending as a good thing its due. It’s kind of debunking the deficit hawks, but in a gentle way, and making the case that in general our government is moving away from the notion that deficits are simply unacceptable.

Bill Morneau can fix Canada’s ‘unholy’ debt mess — if he has the guts

https://nationalpost.com/news/politics/john-ivison-cleaning-up-canadas-unholy-debt-mess-needs-bill-morneau-to-become-paul-martin

This article skirts the edge of getting it wrong, but mostly gets it right, and more importantly, is the only article from the rabidly right-wing Post Media empire that isn’t purely ideological neoliberal fear mongering.

The real problem, which should put this article in the “got it wrong” category, is this: “Realistically, the hard choice remains between raising taxes and reducing spending. McGill’s Ragan said one of his chief concerns is the inter-generational inequity of leaving our children and grandchildren to pay for the current bailout.“

Yes, they brought up the spectre of our grandchildren being oh-so burdened by our debt. Which should put it in the “wrong” category, but the author didn’t say it, and for a Post article to otherwise give a fairly balanced and non-conservative-fear-mongering take, I must give credit where due.

“governments around the world are issuing debt and it’s not clear whether private capital markets will absorb it all, or, if they do, at what rates.” And? Who cares if they do or not, that’s the beauty of being monetarily sovereign and owning the BoC, it can and will absorb whatever markets don’t. This baseless fear is repeated many times in the following articles.

One other small error, but it’s not clear if he just kind of misstated the history: “Canada’s experience in the mid-1990s… Soaring debt levels were compounded by high interest rates, as the Bank of Canada tried to curb inflation.” Actually we had already curbed inflation by the mid-90s, and BoC Governor’s obsession with it already brought on an unnecessary home-grown recession in the early 90s. The high interest rates and inflation were more prevalent in the 80s, not the 90s.

The Bank of Canada: In Crisis and Beyond

https://socialistproject.ca/2020/06/bank-of-canada-in-crisis-and-beyond/

While this article has its heart in the right place, it gets some things right about the BoC and COVID funding, and SO much wrong about the history of the BoC. Much of the mythology I debunk in my article “Much Ado about 1974” is scattered throughout the article, no surprise as the author used as a source the absolute WORST and most mythological article out there: “The Bank of Canada should be reinstated to its original mandated purposes“. So much for Aquanno fact-checking, he ate up the myth from the opinion piece of a non-journalistic source hook, line, and sinker. I’ve been planning an article to specifically debunk all those articles propagating the myth, and it can’t come soon enough when people are STILL parroting the misinformation.

While there is more right than wrong in the article, there’s still some important details that need to be refuted. A common irony I mention in a previous article, when a progressive that rails against neoliberalism still subscribes to neoliberal fictions, “whereas the thrust of the bank’s policies have aimed at supporting credit conditions in the near term, the deficits governments accumulate will have long-term political implications, especially since the additional debt load will not build new productive capacity.“

Whatever the “long term political implications” may become, is Aquanno suggesting we curb this needed funding? Why assume any political implications for such extenuating circumstances when we’re clearly in uncharted territory? And requiring the debt load to build productive capacity is pure neoliberal logic to demonize public spending that does not result in economic growth and corporate profits. Why decry neoliberalism at the start of the article and then use neoliberal fear mongering in the middle?

“Making matters worse, the bank has not committed to any form of yield curve control to ensure that government funding costs remain low in the years following the crisis… for they fail to address the discipline imposed on governments by private debt holders in the form of higher interest rates or investment strikes” I guess Aquanno doesn’t understand that the BoC sets interest rates, not the market? And that the feds can issue whatever interest rate of bonds they please and the BoC will scoop whatever the market doesn’t? Who cares about investment strikes, that’s carte blanche for the government to fill in the gap and cut out private investors altogether so the public will finally realize we don’t need such parasites. Yet again, decrying neoliberalism then ironically propagating its fear mongering.

“Canadian governments will be forced to contend with unprecedented budget shortfalls and the need to use private markets as their main source of financing.” Except will they? The feds sure don’t need private bondholders, and the BoC could buy provincial debt and even municipal debt as it is currently. Not saying that will happen, but why assume one way or the other? Again, uncharted territory, if the feds want the wealth vacuum for the elite we call an economy to survive COVID they will do whatever’s necessary, who knows that that will require in these uncertain times?

“the Bank of Canada has unique institutional capacities that can limit financial discipline and pre-emptively de-rail austerity measures” If he’s talking about private banks, correct, if he’s talking about the feds, incorrect. As the very last critique at the bottom of this web page states, a quote from our BoC governor, the BoC decides NOTHING about fiscal policy, that’s the feds job, and the BoC will accommodate WHATEVER spending the feds desire. The BoC is neutral regarding such things and that’s how it should be, it does not make political decisions, that’s for Parliament.

“A more ambitious strategy involves the development of a new public bank… This would transform debt into a public asset“. Federal debt already IS a public asset when the public holds that debt. When the BoC holds our debt it does nothing for us, but when sold to the private sector it is their asset now. And because we are monetarily sovereign and nothing can cause a default on debt so the feds can carry it forever, a federal deficit is a private sector surplus.

With all its faults that article ALMOST made it into the next category, but the good did outweigh the bad, and there were some great ideas in there about democratized public banking.

Those that got it very wrong:

The real question to ask about those that got it wrong, whether politician or journalist, is if those getting it wrong actually know better and are just supporting an ideological position? It’s baffling to me, through my years of independent layman’s research, that people in positions of power, the people that make the decisions that spend our public dollars, seem to be completely clueless about the monetary system and government finance. In the case of our politicians, especially those tasked with finance, my impression is they willingly and knowingly propagate neoliberal myths in order to facilitate the corporate agenda they are very much on side with. Otherwise, we must admit, we are electing some brainlessly ignorant people into government.

In government spending and deficits, we’re now No. 1 in the world

https://financialpost.com/opinion/jack-m-mintz-in-government-spending-and-deficits-were-now-no-1-in-the-world

Ugh, the subheading of this article primes a person for just how ideologically ignorant the rest of the article will prove “Unproductive public spending outstripping economic growth will be our real albatross threatening prosperity in years ahead“. For those unfamiliar it must be understood, the Financial Post is one of the most unabashedly neoliberal rags ever published, nearly EVERY article they publish is just right-wing neoliberal ideological tripe designed to misinform the public and reassure Big Business.

It goes on to lament about Canada’s deficit-to-GDP as the largest of all nations, but taken without context it’s meaningless. Because we don’t really know what’s happening on either side of that ratio. Is deficit spending much higher because the government is overspending, or is GDP lower because our economy is underperforming? The real question to ask is: does EITHER measure matter?

We are in unprecedented times, COVID has knocked every nation for a loop, and they’re ALL doing unconventional monetary and fiscal policy. So what exactly does that measure tell us other than the government is deficit spending to keep everyone afloat? The fact it’s higher than other nations, especially Europe, can mean either we’re supporting our public with a greater cushion of federal spending, or that we needed more support by comparison because European nations already had a decent cushion built in.

Mintz continues ignorantly throwing out every scary economic number he can think of, every measure that makes Canada look bad, all while completely ignoring the ONLY measure worth looking at: the results of the spending. Are people starving in the streets? Is there an inflationary storm of public spending? No? Then it seems we’re neither doing too little nor too much spending.

He then continues, true to partisan ideologue style, by throwing conservative red herrings about the WE scandal around, as if that pittance of spending is somehow solely responsible for the ballooning deficit. He makes his ideological resistance worse by projecting unfounded speculation that the CRB will deter people from working, because, you know, everyone loves earning the bare minimum and being unable to afford luxuries.

This next line gets to the very heart of why I wrote “What About the Grandchildren” because he trots that red herring out without any shame: “Doling out money may be a politician’s dream, but it will be a nightmare for our children and grandchildren when the bill comes due.” Such ignorant fear mongering ought to be illegal, but apparently putting “FP Comment” before the article is license to throw out any wildly unfounded ideological conjecture the author wishes with impunity.

His comments about the US are laughable in the face of their COVID response and difficulty dealing with the virus. I honestly cannot understand why he holds any of the lame US response as something to be admired, it only reveals just what a blind ideologue he is. Only someone from the elite could make such comments and look themselves in the mirror.

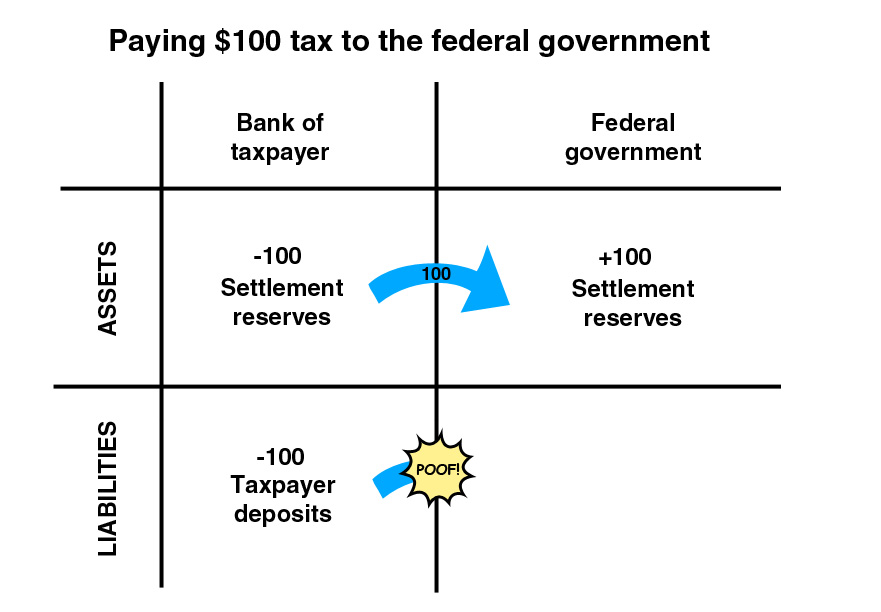

It gets worse, he can’t help but end the article with yet another neoliberal conservative myth, “But the public’s belief that government spending comes from a magical money pot will eventually have to be revised.” Except it DOES come from a magical money pot, it’s called the Bank of Canada. Does Mintz still believe we need to mine gold to create money? That begs the question: is he that supremely ignorant, or is he just another conservative ideologue trying to pull the wool over our eyes?

Justin Trudeau’s credibility as a fiscal manager is shot; he’ll have to curb spending to get it back

https://financialpost.com/news/economy/justin-trudeaus-credibility-as-a-fiscal-manager-is-shot-hell-have-to-restrain-spending-to-get-it-back/wcm/34fc8c33-4610-4132-89d6-039df1571722/

It’s probably a pointless exercise in futility (or at least needlessly redundant) to debunk yet another article by the pro-corporate neoliberal rag known as the Financial Post, but the myths within this article do vary from the last. Of course, it all begins with wildly fantastical fear mongering in the subheading: “Calls grow for a ‘fiscal anchor’ to prevent a return of the ‘northern peso’“

The northern peso, really? The author goes on to parrot the neoliberal fear mongering that convinced Chrétien to make his devastating cuts in the 90s, despite the fact (yes, I’m going to mention it again) that Japan was already WAY higher debt-GDP ratio than Canada and they weren’t exploding with hyperinflation or watching their economy fully collapse. Well, I say “convinced” but I do not believe Chrétien or Finance Minister Martin needed any convincing. Does the quarterback need to convince the wide receiver to catch his throw? No, because they’re on the same team working towards the same goals. The team is called “neoliberalism” and the goal is corporate hegemony.

It’s actually kind of enraging to debunk this article, because it’s even more rife with falsehoods and distortions of the truth. For example, “In early 1995, creditors demanded yields of around nine per cent to lend the federal government money for 10 years, pushing interest payments to more than 30 per cent of revenue.”

That’s pretty much an out and out lie. Firstly, investors cannot compel the government to set interest rates on bonds, and being monetarily sovereign, and with the BoC by convention scooping up any bonds not sold at auction, there is never a possibility the government will fail to sell bonds. The second falsehood (two in one sentence!) is that interest payments were ALREADY that percentage because of the high rates of the early 80s, not because of new bond issues. But the author pushes the double fiction that all of that is because of Canada’s debt levels causing external powers to force their hand. What a load of tripe!

It gets worse “With a debt approaching 70 per cent of gross domestic product, Canada looked like a risky bet and investors demanded extra compensation for the possibility that the federal government would default.” This is one of those cases where it’s not clear if the author is just that incredibly ignorant of the reality of a monetarily sovereign government or if they are intentionally lying to the public? We are MONETARILY SOVEREIGN, we own our central bank and control our currency, it is literally IMPOSSIBLE for us to default. The whole point of having a central bank as “lender of last resort” is so that we can ALWAYS pay our bills! What a lying shill!

Ugh, it’s so much easier writing about the good articles, in this case I have to stop every paragraph because there’e another falsehood, “Don Drummond, an associate deputy minister at Finance when Jean Chrétien’s government finally reversed a couple of decades of overspending“. As the Mimoto study has proven, there was NO overspending, our debt and deficits troubles started with tax cuts at the same time as the collapse of Bretton Woods, leading into the inflationary storm of the OPEC oil crisis, worsened by a homegrown wage-price spiral, and then we floundered around with monetarism for a while without improving anything.

The greatest irony is when former BoC Governor David Dodge chimes in about debt service costs and the impact of taxes on the middle class, as if he doesn’t know the reality of federal finance. But if there’s anything that makes neoliberalism an impenetrable fortress for reformers it’s the fact its proponents are all united in its tenets and ideology. There is only ONE fiscal anchor: did the spending produce equitable results without inflation or other negative effects?

He then goes on to mention a ratings downgrade, as if those agencies have ANY credibility after the 08/09 financial crisis where those same corrupt agencies rated toxic MBS as AAA and directly contributed to the economic disaster. Why does anyone listen to those corporate shills anymore?

In a bizarre twist, no lack of irony in this article, the author then goes on to talk about how we’ve learned central banks can create vast amounts of money without inflationary consequence, and that has “run the bond vigilantes that Dodge and others worried about in the 1980s and 1990s out of town“. So which is it? Do we have to worry about pressure to sell our bonds at a certain price, or not? The rest becomes some weird downplaying of all the fear mongering the author built up over the article, stating correctly many of the realities he railed against earlier. By the end I really have to wonder if he wrote what he believes, or what the FP wanted him to write for their corporate masters?

Top bankers warn Ottawa about Canada’s spiralling debt

https://financialpost.com/news/economy/bank-chiefs-said-to-warn-trudeau-against-spiraling-canada-debt/wcm/24dd090c-5ead-4c91-b018-d12a738a42fc/

Alright, I know it’s getting repetitive, but one more article from the FP in need of debunking. Right off the bat the falsehoods and fear mongering starts, “Canada’s largest lenders are warning Prime Minister Justin Trudeau’s government it doesn’t have carte blanche to run massive budget deficits“. Um, yes, they do have carte blanche, because the BoC can fund whatever the government pleases, without or without the banks.

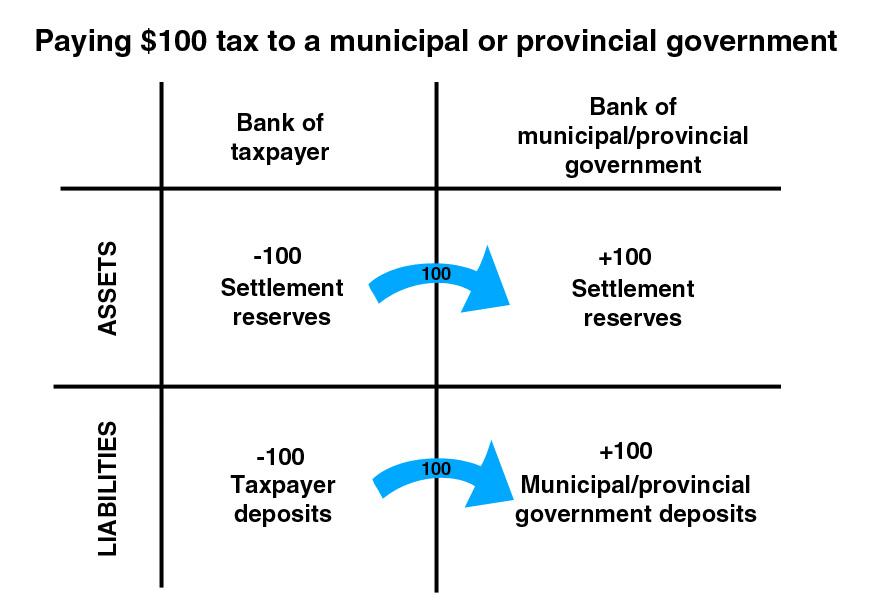

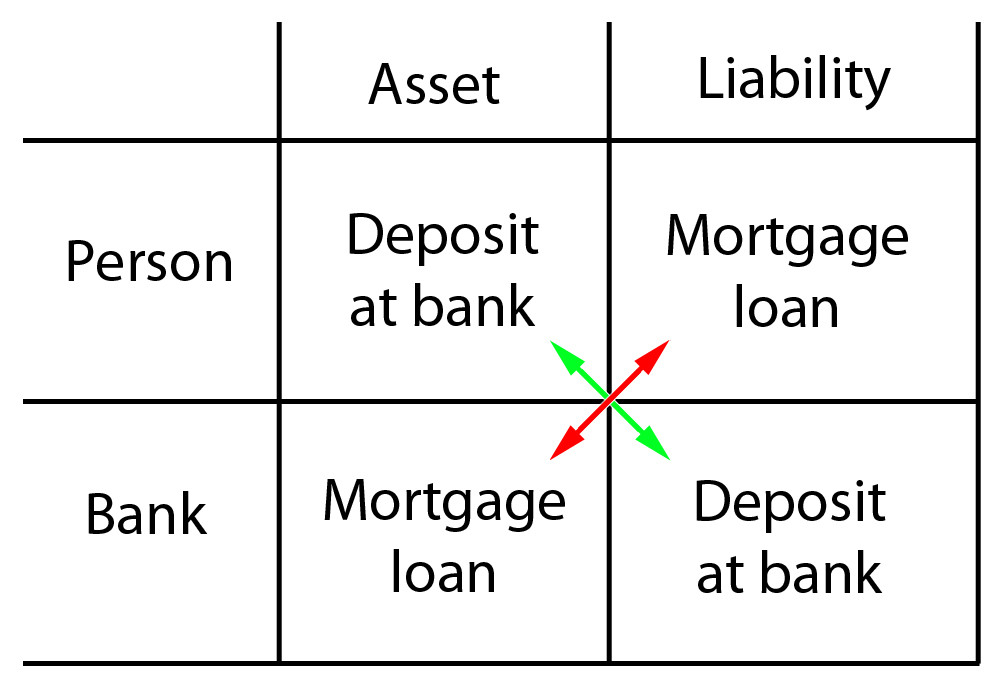

This notion of “lending” by banks gets back to part of my explanation in the grandchildren article. When “lending” to the feds the banks aren’t creating new money through a loan like when they give a person a mortgage, they are swapping existing settlement reserves the government spent into the economy for bonds. That’s all, it’s just a trade, their reserves for the government’s bonds. And if the government so chooses it can, through the BoC, fund everything without a single bond sold to the private sector.

The next quote kinda repeats the same neoliberal nonsense, as if the banks have any control over the feds finances, “while low interest rates provide some scope to borrow more in coming years to support the recovery, it’s imperative the government recommit to specific new debt targets to impose discipline on the budgeting process.” Or else… what?

Who is going to impose this discipline if the government won’t? Will banks simply stop accepting government cheques? This crazy notion that banks control our government is just the worst neoliberal fiction, they have absolutely NO POWER over our government, they can easily be cut right out of the loop and they know it. So their neoliberal sycophants and lackeys create this illusion that somehow the banks can impose their will on the government. Newsflash: THEY CAN’T!

So… hard… to… keep… reading… this… BULLSHIT! “But that would need to come with a hard commitment to bring the debt burden down gradually in order to ease concern about the nation’s fiscal path, they said, possibly by introducing legislation to force the government to lower its debt ratio.” So, who’s going to introduce and pass this legislation? The banks? Investment houses? Foreign powers? This would be self-imposed by government itself, and would be the stupidest thing to do. Talk about an inflexible and brainless policy, no different from the limitations of the Maastricht Treaty preventing European central banks from buying their government’s bonds, or the self-imposed US debt ceiling. The OUTCOME is what’s important, not the numbers that got us there.

In the 90s under Governor Crow they once talked of enshrining inflation as the primary concern of the Bank of Canada into law, thankfully cooler heads prevailed and they didn’t. We need policy FLEXIBILITY, not to rigidly think the evolving needs of the public are going to conform to the formulas of left-brained technocrats.

Of course the article just blathers on with more inconsequential nonsense and fear mongering. Someone once told me no credible financial or business person actually reads the Financial Post, which considering the dry subject matter, makes me wonder who does read this unmitigated complete and utter neoliberal conservative bullshit?

Freeland Grilled By Tory Finance Critic On Ballooning Government Debt

https://www.huffingtonpost.ca/entry/freeland-covid19-pandemic-relief_ca_5fa56330c5b623bfac4ebe97

Pierre Poilievre is one of those rabidly ideological CONservatives that would oppose the government saving his grandmother if it meant deficit spending. As finance critic it’s not clear if he’s just that ignorant of the system he is supposed to be critiquing, or if this is all just part of the show Cons put on for their equally ideological followers.

Poilievre spouts a bunch of nonsensical hysteria, but most telling is this “she won’t tell us whether the debt will be paid back before interest rates rise“. First of all, under the circumstances of extraordinary COVID funding, how could ANYONE predict that? The crisis is ongoing, we’re not remotely back to normal, so what’s his hurry?

More importantly, what difference does it make if interest rates rise when you are a monetarily sovereign nation (see the grandchildren article for an explanation of that term)? Interest rates have ZERO bearing on the government’s ability to fund its deficit spending. And if they do rise, it’s because the economy is getting back on track. The truly silly part though is that with how low interest rates are, our bonds are locked in to that interest rate until they mature. The BoC could raise rates to 10% tomorrow and it would not affect the cost of our existing debt one iota. Either this guy’s an ideological conservative rube ignorant of reality, or he’s just another political psychopath riling people up with falsehoods and rhetoric for his party’s gain.

An interesting if not insidious piece of info in this article: the parties all dipped into the wage subsidy to fund their party offices, a bit of a dubious use, but I guess it’s still a legitimate job.

NDP Steps Up Push For New Tax On Wealthy, Companies ‘Profiteering’ From Pandemic

https://www.huffingtonpost.ca/entry/jagmeet-singh-super-wealth-tax_ca_5fa31df5c5b6f1e97fe675a6

This is one of those sad examples where the leader of a supposedly progressive party, the NDP, none the less panders to neoliberal thinking and advocates for taxes based on conservative logic.

Sure, tax the wealthy for all kinds of equitable reasons, but not for the falsehood that our federal debt is somehow a burden. This line sums up the falsehood well:

“Singh said ordinary Canadians are becoming “more and more worried” about shouldering the burden of slaying the deficit, warning it could mean eventual government cuts to health care and social programs.“

“To pay for the programs, the help that people need, it should not be you that has to pay for it,” Singh said. “It should not be families and people and workers and small businesses who have struggled. It should be those who have profited off the pandemic, it should be the ultra-wealthy that contribute their fair share.”

I hope readers have been paying attention and know what nonsense talk that is, that we do not require ANYONE to pay taxes for the feds to fund the needs of the public. The article goes on and on about what we can “afford” if we implement such a tax, even though we can already afford whatever we please without any tax. Putting it in this frame only propagates the neoliberal fiction and plays into conservative-minded sympathies. Yes, tax the ultra wealthy and supranational corporations to level the playing field, but not because if we don’t do so we can’t afford to fund the needs of the public.

Deficits Matter And Federal Aid Programs Won’t Last Forever: Freeland

https://www.huffingtonpost.ca/entry/freeland-covid-aid-programs-deficit_ca_5f99c518c5b6aab57a0ee4c7

Then of course our Liberal finance minister Freeland goes partly progressive by not shying away from more deficit spending, but then ensures the neoliberals she is still very much on their side when she states, “Whether on Bay Street or Main Street, there are no blank cheques, and there are no free lunches. Our fiscally expansive approach to fighting the coronavirus cannot and will not be infinite.”

No free lunch? Do tell, other than the salary of the person typing the numbers into a computer, what’s the cost to creating more supply of a virtual currency? The only costs are people and resources, the money is not a cost because it does not exist in the real world, and people starving in the streets is a much greater cost.

The approach should be whatever is necessary, and yes, that debt might just exist into infinity unless she expects a looming currency reset or debt jubilee, or sees some end to the nation of Canada some time soon. This is the kind of neoliberal posturing we’ve come to expect from our elite politicians, they say progressive things to soothe the public, but then follow it up with reassurances to Big Business and conservative ideologues.

The neoliberal bent is even more pronounced when she said, “the federal government will impose spending limits upon itself, rather than waiting for “more brutal external restraints” from international market forces.” What, pray tell, are these “more brutal external restraints” and how can they be imposed on a monetarily sovereign nation? This is pure neoliberal scare tactics to impose farcical discipline on federal spending as if that discipline could ever be imposed from the outside.

This smacks of the same neoliberal thinking that led Chretien to make his devastating cuts in the 90s, merely because ratings agencies and the financial world had some beef with our deficit (ignoring of course the example of Japan). Bill Mitchell addresses this incredibly well in his article “Overt Monetary Financing – Again” when he writes:

“The sense of fright is driven by a lack of education that leaves people unable to comprehend how the economy actually operates.

“Neo-liberals magnify that sense of fright, by demonising what are otherwise sensible and viable explanations of economic matters.

“They know that by elevating these ideas into the domain of fear and taboo, they increase the probability that political acceptance of the ideas will not be forthcoming.

“That strategy advances their ideological agenda. The basic rules that should guide government fiscal policy are, as Lerner noted, “extremely simple” and “it is this simplicity which makes the public suspect it as too slick”.

“Neo-liberals who have vested interests in ensuring that the public does not understand the true options available to a government that issues its own currency manipulate that suspicion.

“In the place of these simple truths, neo-liberals advance a sequence of myths and metaphors that they know will resonate with the public and become the ‘reality’… I’m often confronted with arguments by sceptics who say ‘the markets’ will be unhappy, or retaliate, but when I asked them, specifically, to articulate exactly what they think the markets (whoever they are) will or can do, I am met with a sort of jumbled set of propositions or more typically, silence.“

So I ask the same of Freeland, what are the “more brutal external restraints”? One might be a depreciation in our exchange rate, but again, considering due to COVID most nations are in the middle of such extraordinary measures, why would Canada be singled out? Especially when those measures aren’t funding government works like infrastructure, but rather are just supporting the minimum of demand to keep profits flowing to our supranational corporations. I think Walmart would be pretty upset if we stopped COVID funding and their customers could no longer afford even their cheap wage slave prices.

What other “brutality” might happen? Corrupt ratings agencies lower our credit rating? And what then? They can do that all they like, it still doesn’t obligate us to raise our interest rates. If banks and investors still feel Canadian bonds are as risk-free and reliable as always, they will invest accordingly. The real joke there is when you realize we don’t actually need to sell our bonds to anyone, domestic or foreign, to fund government spending, so what is the fear?

The only other possibility that might happen, a la Venezuela, is sanctions. Again, is the world going to single Canada out as deserving sanctions, especially considering how incredibly corporate-friendly a nation we are? What then are these supposed “more brutal external restraints”?

I just have to throw in a great example of alchenomics: “Officials estimate the economy will still shrink by 5.7 per cent this year, but grow by 4.2 per cent next year, and 3.7 per cent in 2022, meaning gross domestic product won’t rebound to pre-pandemic levels for another two years.” They have absolutely NO WAY of knowing any of that, and I would bet all my savings they will be proven wrong. We never truly bounced back from the 08/09 crisis, now with COVID we’re even deeper in uncharted territory and the old rules apply less than ever. Economic forecasting is worse than weather forecasting. The longer the horizon the more incorrect it will be, and with the increasing volatility in the climate being a pathetic fallacy for the increasing volatility in stock markets, add in COVID, who can predict ANYTHING for sure anymore?

There is one EXCELLENT tidbit in this article however, that lays bare the farce of central bank independence, when the Governor of the BoC says, “As for how long the aid should last, Macklem said it was up to the government.” UP TO THE GOVERNMENT, meaning the central bank will accommodate WHATEVER spending the elected government has decided on. Meaning, yet again, we have another admission from the powers that be that there actually is nothing in the way of them funding a more equitable society for all other than their own lack of action.

Adam Smith, 21st Century