“We’ll be passing the bill to the next generation!”

“We’re indebting the future of Canadians!”

“Higher deficits today mean higher taxes tomorrow!”

“We’re living beyond our means!”

“WHAT ABOUT THE GRANDCHILDREN?!?!”

Oh the ironic baseless cries and fear mongering about federal debt and deficit! Ironic because federal debt and deficits have actually been the key to our growth and prosperity, baseless and nothing to be feared because we’re a nation that is monetarily sovereign and owns its central bank. Which means through the Bank of Canada the federal government controls the Canadian dollar and can independently create at will as much of it as we need at any point in time.

Don’t take it from me, here it is from the feds, “As the nation’s central bank, the Bank [of Canada] is the ultimate source of liquid funds to the Canadian financial system and has the power and operational ability to create Canadian-dollar liquidity [money] in unlimited amounts at any time.” In unlimited amounts at any time.

I had always planned to eventually write a follow-up to my article “Where did Trudeau get that CoVID cash?”, about what the changes to the BoC balance sheet all mean in the long run, but I am forced to fast track it because there is FAR too much ignorance and fear mongering in the media and government about debt/deficit concerns. I am hoping to dispel that ignorance and allay those fears, but the neoliberal indoctrination of the public is DEEP.

However, if you’re reading this it means you aren’t satisfied with the official line and have an inkling something deeper is afoot, that we’re not being told the whole truth. You are here to dispel the neoliberal myths, to pull the wool from your eyes, and to get a peek behind the curtain of federal finance and the monetary system. And I applaud you for it, we need a more informed citizenry able to think for themselves, people not satisfied with the ongoing lies and distortions of the political elite in service to the corporate elite (often they are one and the same). I can’t promise all of my explanation will be simple and easy to understand, finance and the monetary system is a convoluted counter-intuitive system, but I’m going to try my damnedest. If you have further questions, please don’t hesitate to comment or contact me.

Without actually reading my article too many people on social media kept commenting as if I was criticizing Trudeau for the COVID funding, when really it was bashing him for NOT funding other needed things and lying about not having the money, like when Trudeau falsely told veterans they’re asking for more than the government can give right now.

The worst part is that people are freaking out over the debt and spending, but you ask them what other choice was there, and they draw a blank. Were the feds supposed to give NO support and just let people lose their homes and businesses and starve in the streets?

It’s this strange ideological knee-jerk hyper-partisan reaction of the indoctrinated public to blindly rail against such spending without giving a single thought to what would happen without it. Many people have been so brainwashed and conditioned by ideological partisan forces to outright reject such policies without giving it a moment’s critical thought, it’s really quite disturbing. Here are all the reasons why we don’t have to worry about our grandchildren being buried under a mountain of debt:

- The media and politicians are hyping up the fear with ignorant and incorrect information

- Debt/deficit hysteria has been empirically debunked… many times

- We control the Canadian Dollar and can monetize debt

- The feds can NEVER go broke and taxes aren’t required to fund spending

- Japan

- Future inflation, growth, and GDP measures

- We don’t ever need to repay it

- Conclusions

1. The media and politicians are hyping up the fear with ignorant and incorrect information

So far no one is hyping up the unfounded fear of debt and deficits more than conservative ideologues, whether the ones elected or those writing for right-wing media like the National Post and the Toronto Sun. As if we don’t have enough history to prove them unequivocally wrong, but still they have no qualms stirring up as much ignorant hate of the government as they can. Historically it’s ALWAYS been selfish ignorant conservatives pushing back against progressive spending by the government.

However, it’s not just conservatives catering to the neoliberal system and telling falsehoods, supposedly progressive parties like the NDP have their leader repeating these myths about debt and deficit too. If politicians and their rhetoric have proven anything over the 85 years of the existence of the BoC it’s how few really understand federal government finance and the monetary system, and how many actively propagate the myths. Isn’t it strange to live in a system where our public spending decisions are governed by people completely ignorant of how the system of that spending works?

But it’s not all bad, the G&M and CBC have had some more reassuring reporting on the topic, and Modern Monetary Theory (MMT) is coming into the common lexicon, even if the media still misrepresent certain facets by parroting the neoliberal fictions. Even John Ivison of the National Post got some stuff correct, although he also repeats many neoliberal myths.

I’ve put my critique of a selection of mainstream media articles into a separate post, I will add to it over time as more articles come out that either require debunking for spreading ignorance or lauding for getting it right.

2. Debt Hysteria and the Deficit Myth empirically debunked… again and again

The other ironic aspect about the public falling for the fear mongering of neoliberal debt/deficit hawks is that their unfounded fears have actually been debunked for decades now by multiple books and groups! Deficit spending has been incorrectly blamed for Canada’s debt woes at every turn since neoliberalism set in in the 70s.

As I thoroughly explored in my paper on the BoC and inflation starting in 1974, books like “The Monetarist Counter-Revolution” by Arthur Donner and Douglas Peters and “Money, Inflation, and the Bank of Canada Vol II” by Thomas Courchene, made it obvious uncontrollable exogenous inflation which then turned into an endogenous wage-price spiral was the main culprit of Canada’s increased debt, and NOT out of control government deficit spending.

Yet in the early 80s, as the hangover of the inflation triggered by OPEC oil crisis was still a concern, (primarily conservative) debt and deficit hawks started clamouring about the public debt with the identical false cries we’re hearing now. By the late 80s, sick of hearing all this bashing of debt and deficits due to supposed government overspending, a couple little known statisticians at Stats Canada, Hideo Mimoto and Murray McIlveen, decided to do their own study about the sources of the growing debt.

Their conclusion? Inflation wasn’t even factored in, the deficits leading to increased debt were primarily due to lost revenue from TAX CUTS in the early to mid-70s. It wasn’t out of control spending causing deficits, it was tax cuts draining revenues, in particular corporate tax cuts, to spur growth that never happened.

Add in the punishingly high interest rates of the early 80s and the debt was growing faster than revenues or GDP to the point in the mid-80s Canadians had actually paid off the principal of the debt and the remainder was all interest. It’s important to note that debt was self-inflicted by the interest rates the BoC itself was setting.

Starting in the late 80s, after the inflation obsession of BoC governor John Crow began, the Committee on Monetary and Economic Reform (COMER) made its mission to debunk the neoliberal narrative about using our central bank more fully, and by the early 90s two COMER publications were openly challenging the fiction. “A Power Unto Itself: The Bank of Canada, The Threat to Our Nation’s Economy” by William Krehm, and “It’s Your Money” by William Hixson.

By mid-90s Linda McQuaig was debunking the deficit myths in “Shooting the Hippo”, and by the early 2000s Timothy Lewis wrote “In the Long Run We’re All Dead: The Canadian Turn to Fiscal Restraint.” Not to mention research papers on the topic, like Seth Klein’s 1992 paper “Good Sense VS Common Sense: Canada’s Debt Debate and Competing Hegemonic Projects”. As you can see, there are ample Canadian sources deflating deficit hysteria.

Now we’ve got MMT to help us debunk, starting with Warren Mosler’s seminal work “Seven Deadly Innocent Frauds of Economic Policy” of which Fraud #2 is “With government deficits, we are leaving our debt burden to our children”, and no better than Stephanie Kelton tackling the subject head-on in her new book “The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy”. Not to mention of course Bill Mitchell’s excellent MMT blog with articles like “Where do we get the funds from to pay our taxes and buy government debt?”

And yet, despite such a thorough debunking by many sources, even the mainstream and well-known Linda McQuaig, decades later we’re still fighting against the misinformation of the neoliberal elite. The problem seems to be mainly that people simply do not understand the monetary system as it exists, instead clinging to the more traditional notion of physical money under a gold standard. People truly have trouble wrapping their heads around the fact money is completely virtual and not backed by anything, they have been fooled into thinking there’s some limit on the creation of money, as if it’s a faucet to a finite reserve water supply instead of merely a virtual faucet with virtual water coming out of it.

3. We control the Canadian Dollar and can monetize debt

It’s really hard getting into explanations of the monetary system without getting technical, because the system was designed as a technocratic vault to dissuade and discourage the average person from attempting to understand it. It is purposefully convoluted, its inner workings well-guarded and veiled, even from private banks, and it only communicates in dense bankspeak that can take years for the uninitiated to wade through (I know, I’ve been slowly deciphering technical papers on the BoC website for years). But this explanation wouldn’t be complete without delving a little into the mechanisms that also blow away the debt/deficit myths. I get a little deeper into the explanation of the basics mechanics of the monetary system in this paper.

Part of the difficulty of the counter-intuitive nature of the system is the notion of federal government “borrowing” when it sells debt like bonds or t-bills. When people think of borrowing or a loan they think, “You have money to lend, I need to borrow it and will pay you interest.” Well that’s how it works between two people, but that’s not how it works between banks and the feds.

When a private bank extends a loan to a person they’re not lending their equity money, they’re not lending their depositor’s money, and they’re not giving money based on some quantity of a commodity like gold. When loaning the banks are creating brand new digital money on the spot. THAT is the power of banks, to create money/credit, such is the core of our debt-based monetary system. Debt creates money, repaying debt destroys money, and all that’s left is the interest payment.

However, when banks buy federal bonds they aren’t loaning the money into existence, they are purchasing the bonds with settlement reserves that were created by the BoC and injected into the banks by government deficit spending. It’s important to understand that crucial detail, that the money banks use to buy federal debt is just money the government spent and didn’t tax back. It’s more like a swap of assets than borrowing: the banks don’t like holding low-interest reserves, and so have the option to swap them for bonds, which not only earn more interest, but banks can sell them to investors and they are used as risk-free general collateral for loans in overnight markets.

Like any bank the BoC can also create funds out of thin air anytime it needs to, whether lending extra settlement reserves to a bank that came up short at the end of the day, or to fund federal government spending. Now here’s where I have no choice but to go a little deeper down the rabbit hole to explain why the debt is no constraint on anything.

As I said previously, Canada is “monetarily sovereign”. What does this mean? It means we have our own distinct national currency, we control the issuance of our currency, our currency is not tied to the currency of any other nation (our exchange rate is “floating”), and as we own and control our central bank, which provides all the settlement reserves that are the backbone of the financial system, no external force can disrupt the internal workings of our currency. All of that adds up to the “unlimited” funding aspect of our federal government. It also means that we control the cost of lending Canadian dollars because the BoC sets the interest rate on settlement reserves (the key policy rate a.k.a. the target for the overnight rate), which then transmits into the interest rates consumers and businesses pay on loans from private banks.

The control of CAD is also essential to defusing fears about foreign-held debt. It does not matter AT ALL if foreign countries own our bonds as along as those bonds are denominated in CAD because we control CAD. Different story for our bonds that are denominated in foreign currencies (primarily US dominations) because we do not control those currencies and if a bondholder needs to be paid out we don’t have the ability to create the money at will because it’s not our currency. But as the vast majority of our federal debt (bonds and t-bills) is in CAD, there is no concern to be had because we can always pay. A foreign nation buying our bonds more or less amounts to that foreign nation keeping a savings account with us in our dollars, it doesn’t mean they own or control our government.

So, how does the BoC create any funds the government needs? Through the magic of monetary financing, also known as “monetizing the debt”. When the government needs funds it releases more bonds to “borrow” from private banks. But it can also borrow from the BoC when the BoC buys its bonds and credits the government’s account at the BoC (the Receiver General account). Here’s another federal government page explaining this.

When the central bank buys bonds straight from the government not only does the government have a bunch of new money to spend, it also means that because the central bank is holding the debt, the repayment of the debt and interest goes right back to the central bank, which we own. At the end of the year all excess profits from the central bank go to the government as revenue. Such is the magic of monetary financing/monetizing the debt: when you hold your own debt you pay yourself interest and there is NO debt burden.

What does all this have to do with the extraordinary CoVID funding? Well, it was entirely done using the ability of the BoC to create money out of thin air. So if we’ve got all this new debt, but the debt is held by our central bank and pays out right back to us, is the debt really a burden? Is it even really fair to call it “debt” at that point seeing as no other economic entity has such powers, not even private banks?

Between the fact we are monetarily sovereign and not restricted (like the US or Eurozone) from monetizing our debt, there is no reason to ever see public debt as a burden, because we always have the means to deal with it.

4. The feds can NEVER go broke and taxes aren’t required to fund spending

Not only is it tough to wrap one’s head around the abstractions of the monetary system, it’s tough to convince people the rules of personal household finance that apply to them DO NOT apply to the federal government. One might even say the reality of federal finance is completely counter-intuitive to the public’s understanding of finance.

For example, the federal government can NEVER go broke. As mentioned at the start of the paper, the BoC can create liquidity (money) in unlimited amounts at any time; the feds can ALWAYS pay their bills. This also means the feds do not require a dime in taxes to spend, a truth the elite neoliberals do not want us to know and that conservative ideologues refuse to accept.

In our system taxes at the federal level serve only three purposes:

- An enforced tax liability creates demand for the domestic currency. If you’re forced to pay taxes in CAD you will conduct business in CAD.

- Taxes send policy signals to the public about the government’s wealth redistribution priorities. Who gets taxed and by how much?

- Taxes are a check on inflation by removing money from the economy. This is an abandoned use ever since neoliberalism set in in the 70s.

Here’s the part where it gets a little tricky, where an MMT person would add, “Federal taxes don’t fund spending”. This is perhaps the MOST counter-intuitive and difficult part of explaining the monetary system. Taxes at the provincial and municipal levels DO fund the government, because those governments are not monetarily sovereign and do not have a central bank. But at the federal level, because the feds do not spend regular deposit money but rather they spend using central bank settlement reserves in the Receiver General account, it enters the system differently.

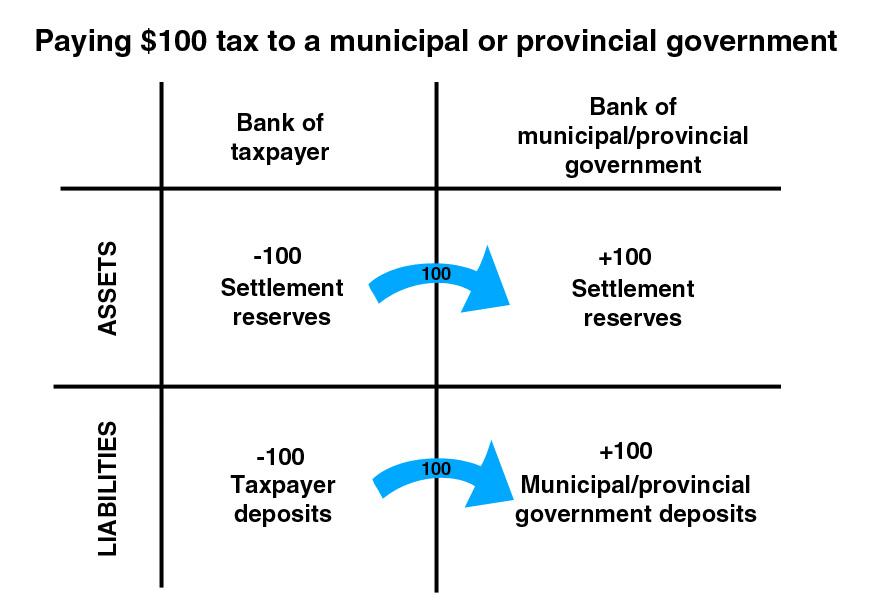

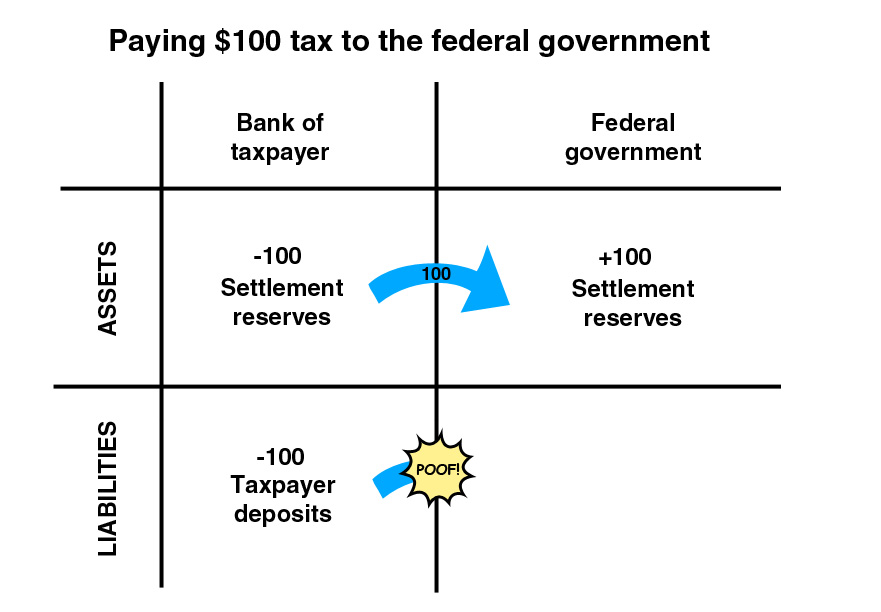

When a provincial or municipal government is paid taxes, those deposits just shift from the bank of the taxpayer to the bank of the provincial or municipal government:

But when the federal government is paid taxes, the deposits DISAPPEAR from the system, and the bank of the taxpayer shifts central bank settlement reserves to the Receiver General account:

When the government spends the opposite happens, it CREATES new deposits with the public, and the Receiver General shifts settlement reserves to the banks to balance the new deposits.

Another way to phrase this is that taxes don’t fund federal spending, rather they simply remove spendable deposit money from the economy. The settlement reserves the bank of taxpayer holds (before shifting them back to the government with the tax payment) are from some form of previous government spending. Whether spending on the public or paying out bonds to the bank, those reserves originated with government deficit spending, meaning that previous government deficit spending is what funded tax payments, not that tax payments are funding government deficit spending. Confusing as hell, I know, but once you wrap your head around these abstractions as MMTers have you start to see the neoliberal fictions about federal debt and deficit for what they are.

Every time the feds spend more than they taxed, a deficit, they leave more money in the hands of the public but also increase government debt. The total federal public debt is just the accumulation of deficits and the interest paid on them, all the money the government spent but didn’t tax back. As we’ll get into later, this puts the burden of the debt on the government, which can roll the debt over forever without consequence, as opposed to putting the debt on the people and requiring strict repayment or face consequences.

You can tell people these facts, that through our central bank the government has unlimited funds and does not require taxes, and people’s faces get all screwed up, the doubts cloud their mind, and they inevitably say something like, “Yeah, but money has to come from SOMEWHERE.” And you ask them “then where does money come from?’ and they are stumped. Because MONEY COMES FROM THIN AIR, it is created “ex nihilo”, this is what’s called a “fiat” monetary system. It’s mostly just numbers in a computer, and a bit of cash and coin.

Yet people have no trouble understanding that the federal government has full control over the printing presses of our notes and the minting of our coins, which while they are physical items, their value is not derived from their physical material but rather whatever number the feds have stamped on the surface. For whatever reason, creating physical cash and coins based on nothing fits in people’s minds, whereas creating digital money out of nothing in a computer at the central bank somehow doesn’t jive. This is a great exercise for someone to really make a person think about the nature of money and where it comes from, as it becomes obvious when you really question a person’s assumptions about money that they haven’t really given it any deep thought.

People have truly been deeply indoctrinated, even brainwashed, by the neoliberal system, they simply cannot imagine the myths are fictions; they take them as gospel truths because they do not dare refute the high priests of finance. The system is too complex, esoteric, and unfamiliar that people simply dismiss any notion of trying to understand it and take the technocratic neoliberal elite at their word, as if these elite working to maintain the status quo of the corporate oligarchy really have the best interests of the public in mind.

For me that’s the real kicker, when people who rail against the machinations of the elite and the horrible inequality of the corporate oligarchy then turn around and attack MMT or monetary reform by parroting the myths of the very elite they claim to decry. As I said on one post recently, “if you’ve been jailed without cause, why would you believe the word of your jailer?”

5. Japan

Ah Japan, MMT poster child and the go-to for any monetary reformer looking to blow away debt and deficit myths. Japan has had the highest debt-GDP ratio on the planet for a couple decades now, and the sky hasn’t fallen. At one point the Bank of Japan was also the largest holder of Yen bonds too. Again, the sky never fell. And ratings agencies keep putting them up and down, and yet investors still put money there and Japan still lends to developing nations.

Despite the fact Japan has the highest debt-to-GDP ratio in the world and the Bank of Japan holds about half of all outstanding government bonds, Japanese interest rates and inflation are exceedingly low. Mainstream economic theory cannot account for these real-world results which completely contradict its predictions. Bill Mitchell writes extensively on the subject of Japan defying neoliberal expectations.

The point is, whatever the neoliberal elite claim can’t or shouldn’t be done with debt and deficits here, Japan proves them wrong. If Japan can do just fine with a 236% debt-GDP ratio then we can too.

6. Future inflation, growth, and GDP measures

This is the aspect that reveals just how purposefully deceptive media financial commentators are being when they whip up debt/deficit hysteria. They know full well the amount of debt by itself is meaningless, and that it is measured against other factors to determine if they perceive it as problematic or not, but they cherry pick the information that looks most worrying to the public and then give it no context or comparison that might soothe the public’s mind. As mentioned earlier, it must be understood, the federal debt is not a burden to the public, the government shoulders that weight, but for those concerned about the debt it can be viewed in more favourable ways and there are factors that will naturally mitigate it over time.

First off, let’s talk inflation. We can throw misguided concerns about hyperinflation right out the window, in another article I address the neoliberal red herrings of the Weimar Republic, Zimbabwe, and Venezuela, the common tropes indoctrinated people trot out as if they are proof that higher public spending automatically means hyperinflation (as opposed to a confluence of variables and external pressures).

I get deep into the Canadian experience with inflation in my paper on the BoC and 1974, but it’s really important to understand from the point of view that inflation erodes the real value of debt. If your debt is accruing interest at 2%, but inflation is at 3%, then in real terms (“real” meaning adjusted for inflation) your debt is actually shrinking by 1%. And with interest rates as low as possible at the effective lower bound, almost ANY amount of future inflation will be eroding that debt.

Now, that may seem insignificant in the short term, and it is, but when talking of inflation and federal debt one must think long term. We sell bonds with as long a maturity as 30 years, inflation at 2% doubles prices in 35 years, or conversely halves the real value of debt. So, over time the real value of that debt is not the same, and so as long as there is some inflation, debt is slowly becoming less significant.

And of course there’s growth to consider. We didn’t get out from under the mountain of debt of WWII by paying it off; we grew our way out of it with the unprecedented growth of the post-war period. If your economy is expanding both in population and consequently GDP, not only is the debt spread between more people, but there is the possibility of running a surplus and paying down some of that debt if we so choose.

As we’ve seen from ratings agencies and the like, debt-GDP is the key measure they use to evaluate debt. Well none of the various levels of governments of Canada have any intention of stopping the growth economy anytime soon, so it’s safe to say there will be growth in GDP in the future. As long as that GDP growth outpaces the growth of new debt, our ratio will slowly improve.

However, growth is completely stagnant at the moment, we’re entering another bout of secular stagnation, and they’ve been having trouble keeping inflation to target since the 08/09 financial crisis, so much so the Deputy Governor of the BoC had a speech musing about the possible need to evolve a new monetary policy not solely concerned with inflation. While these factors are troublesome to the neoliberal system, they also crack wide open how inflexible and insufficient this system is if it cannot be sustained with a natural ebb and flow of economic activity instead of requiring infinite exponential growth.

(as a brief side note, it’s very satisfying for me to see our ultra-neoliberal former Finance Minister Bill Morneau proved completely wrong about inflation and monetary financing. As I wrote in a letter to the feds, when a federal e-petition for increased use of the BoC to fund federal spending was presented, Morneau’s ignorant lame duck response was to outright lie and dismissively claim “that would be inflationary”. Now we’re at our highest level of monetary financing EVER, with the BoC holding over 35% of federal debt, all while the government has been spending like mad, and there’s still no inflationary storm on the horizon. Well there was already enough empirical evidence from Canada proving Morneau wrong then, and now he is living the proof he is wrong, as he watches the government do without inflationary consequence what he claimed they couldn’t)

7. We don’t ever need to repay it

I saved this for last because it is indeed the most important. When people cry about future generations paying the debt the question to ask is, “when have we EVER paid back all our debt?” The answer is NEVER, and we never will.

As a monetarily sovereign nation we can always pay off maturing debt, that’s the whole point of the BoC, to backstop the entire system so it’s quite impossible for the feds to ever be insolvent or default on debt payments. With ongoing deficit spending most of the last 40 years the feds just keep rolling over old debt with new debt and adding as much extra needed to cover the deficit spending. There is absolutely no obligation or need for the feds to pay down their debt, ever.

Every nation will go into debt into infinity or until their economy collapses and causes a reset, such is the nature of a debt-based monetary system. The supply of money for federal spending cannot expand without federal debt expanding too, but the beauty of monetary financing means the BoC can hold all the debt if we so chose. So is it really “debt” when we owe it to ourselves?

There is an important aspect of deficits that the neoliberals do not like to admit to and strive to hide when they foment fear over deficits: a federal deficit is a private sector surplus. When I said above that the debt is the cumulative total of all federal deficits and their interest, and all of that is money the government spent and didn’t tax back, what I’m saying is that deficit spending leaves more money in the hands of the public. This gets back into the counter-intuitive nature of federal spending not being at all comparable to a household.

When you are a business or household, usually a deficit is bad, it means you are spending more than you earn. But as a business or household you do not have the unlimited funds of a central bank at your disposal, nor the longevity and immortality of a government, so you cannot go into deficit for too long without consequences like having your house repossessed or going bankrupt. The feds on the other hand can never go bankrupt or be unable to pay a bill. And the money they spend ends up in the hands of the public, which can be further spent into the economy or saved.

As a business or household a surplus is good, it means you have more money coming in than going out. A federal government surplus on the other hand means the government is taking back MORE in taxes than it’s paying out in services. Basically we are getting less from the government than we are giving. So why the fear of deficits if it means more money in the hands of the public, and government debt can be and is rolled over all the time?

Most people don’t realize the only* way to pay down federal debt is by running surpluses. It’s just the accounting of the system: you cannot pay down federal debt except with taxes, you won’t have more taxes than spending unless you run a surplus, and you won’t have a surplus unless you either cut spending or raise taxes. It’s a zero sum game, and decades of dubious neoliberal tax cuts to spur growth that never emerged has left government debt pretty much unrepayable without massive taxation.

(*the central bank also has the power to run negative equity to retire bonds, which completely removes any need for government debt to fund spending ever, but the central bank holding negative equity is not acceptable behaviour to neoliberal technocrats and so I don’t include it as an option)

Once you realize that tax cuts created the excess debt, and only running surpluses taking in more taxes than spending can pay down debt, you will see that it’s simply not possible to pay down all the debt without draining the economy of large sums of money. As mentioned, most of the debt now isn’t even from deficit spending but rather the leftover interest from our ridiculously high rates in the 80s.

Really though, who ever expected any sovereign nation to pay off all their public debt? Once you explain that to pay off public debt requires a surplus in which the government taxes more than they spend many people do not like that idea. Then one can see the choice: tax more than spend to pay down debt and reduce its perceived burden, or, enjoy the fruits of deficit spending and only pay taxes as determined by the government’s sense of social equity.

Regarding paying interest on the debt, it’s another red herring trotted out by conservative neoliberals. While massive interest payments on our debt was one of the justifications used for the austerity of the Chrétien cuts in the mid-90s, those payments were never any constraint on government spending. As I hope I’ve shown, the government is NEVER constrained by a lack of revenues or the need to spend more on interest, the BoC can credit any entity the government needs it to. Those cuts were a neoliberal choice to appease financial markets and ratings agencies, and they devastated our public service.

It must also be understood, the government doesn’t need revenues to pay that interest on the public debt, when bonds mature the BoC just credits the account of the bondholder by the value of the maturing bonds. The interest payments show up as a line item on our federal budget, but as with ALL spending the BoC just creates it, we don’t need to wait to collect enough taxes to pay that interest. Meaning the interest is not a burden either, it can build up as high as it likes, the BoC and government can and will always pay it out. Banks rarely even take their payout from bonds maturing, rather they simply roll them over into a new issue of bonds from the government, because those bonds will pay more interest and have more uses (like to influence long term interest rates or as collateral for lending in overnight markets) than holding settlement reserves instead.

8. Conclusions

Well I hope the conclusion is obvious: we need not fear debt or deficits! It was silly to fear in the first place when you understand we are monetarily sovereign, and that fear serves the wealthy elite by making people afraid of imaginary invented consequences of government spending on the public. It arbitrarily circumscribes government support and serves to retrench and create austerity for no other reason than it maintains a desperate work force, suppresses wages, and keeps a stock of unemployed so that corporate profits can be maintained at the highest possible level.

We need to shift our thinking, there is no need in a modern economy for everyone to be reliant on paid employment, but also no need for people to be unemployed if there are jobs needing to be done and people willing to do the work. A basic income is getting alot of attention now, and the MMT crowd is pushing for a job guarantee. Whatever the solution we know one thing: money is NEVER a constraint for our monetarily sovereign federal government.

Adam Smith, 21st Century

BIG thanks to Larry Kazdan of MMT Canada for all his help keeping me on the level.