By Adam Smith, 21st Century

This paper is dedicated to John Monroe and Michael Karp, without whose exposing of my ignorance on the monetary system I would not have found impetus to delve as deeply as I have.

- Why should YOU care?

- How I got here

- The basics of the monetary system

- The MYTH

- So what DID happen in 1974?

- Conclusions

- The Future

- Bibliography

Ah the Bank and Canada and 1974! I don’t think there’s a central bank in the world with more wild mythology surrounding a precise point in time. I must admit however, were it not for this mythology I would not have found myself motivated to dig as deeply as I have to find the truth. In revealing this truth to others I have been called a government apologist and/or shill, a secret insider of “controlled opposition”, and many other names by ideologues whose conspiracy theorist identity is so wrapped up in the myth that their confirmation bias won’t allow them to accept new facts that belie their prior misinformation. The truth creates a cognitive dissonance their mind cannot accept, the irony being these people spent so much time researching bunk sites for false info but refuse to look elsewhere because the truth doesn’t fit their narrative.

I’m not doing this to justify or defend our monetary system, it is in serious need of reform as it is simply another gear in the inequality engine/wealth vacuum for the elite we call an “economy”, but the truth needs to be told, we cannot fight for change based on false history and misunderstood systems.

Why should YOU care?

Going deep down the rabbit hole of our monetary system with a view to reforming it, I find after ranting about the system and divulging its intricacies I’m often asked the question by the average person: “why should I care?” Knowing as much as I do it seems self evident, but the biggest obstacle to monetary reform is how unfamiliar and esoteric the topic is for the vast majority of people, not to mention it can be highly technical (and therefore boring or simply unintelligible to most). This seems to breed apathy and indifference in most people who seem content to unquestioningly leave it to neoliberal politicians and bean counters. They don’t really grasp that these numbers and accounting are ruling ALL our lives, and that the logic applied to these systems is specious at best, and parasitic at worst.

I’ll likely expand on this in its own post one day, but for now here’s the main reasons EVERYONE should care about reforming the monetary system:

- WE’RE BEING LIED TO. Not necessarily intentionally, most politicians have been deeply indoctrinated in neoliberal logic, through their education and institutional experiences (the Washington Consensus is a great example), and very few understand even the rudimentary basics of the monetary system, so it’s very likely they don’t even know they are spreading a falsehood. Every time a Canadian federal politician says “We don’t have the money” it’s a lie, like when Trudeau told an injured veteran “You’re asking for more than we’re able to give right now” that is complete and utter bullshit. You don’t see Trudeau telling TransMountain that when he shelled out $4.5 billion in corporate welfare overpaying for a pipeline no one in the private sector wanted. Because we are a sovereign nation with our own currency and a public central bank we literally have the power to create money for anything we want. We pull out all the stops in times of war, but then force austerity and unemployment in times of peace, to ensure a steady flow of profits to our largest supranational corporations. It’s time to start calling out the lie, money is imaginary, to say we don’t have enough is to say we don’t have enough imagination.

- Banks profit off EVERYTHING in the economy and their obscene level of profits gives them a powerful lobby. Due to the nature of our debt-based monetary system, in which private banks create most of what we use as money, it puts them at the center of ALL economic activity. Even the black market needs banks when their ill-gotten gains need laundering. There is almost no legitimate economic transaction that does not involve a bank, and therefore earns them fees and/or interest. Canadians are all too familiar with the billion dollar profits of our highly concentrated banking

cartelsector, but most people don’t realize those profits translate into a powerful lobby to influence government policy. Pretty much all our banking law reforms the last 40 years were made in close consultation with the banks, more or less written by the banks themselves (like when they successfully lobbied for the elimination of reserve requirements, claiming it was like a tax, ensuring they earn money off every dime of government spending, as if that’s not a tax on the rest of us). A system that allows such power and profits to accrue is neither democratic nor equitable, and we need to fix that. - We are being denied much needed public works and services in order to maintain and strengthen the supremacy of the private sector while weakening and gutting the public sector. Politicians spend time cutting taxes, starving the government of revenue for growth that is never realized (except for the growth in profits of corporations and the wealthy), privatize public assets on the cheap for one-off payouts, and then they turn around and tell us regular folk we must tighten our belts and accept austerity. The truth is that technically speaking the federal government doesn’t require a dime in taxes to continue spending on the public, they could provide us any funding we need for infrastructure or services. This isn’t to say we can spend on everything we’ve ever wanted, there are still real constraints like availability of resources and labour, and we do need to watch for inflation, but the lie of austerity is laid bare when certain favoured sectors receive subsidies and tax breaks while necessary public spending falls by the wayside. Chomsky said it best, “That’s the standard technique of privatization: defund, make sure things don’t work, people get angry, you hand it over to private capital.” We are being denied funding for needed public works for no other reason than neoliberal ideology prioritizing the largest players in the private sector, trying to ensure any public project profits them.

There is quite literally NO LIMIT to the funds the BoC can create for the government, and no constraints on that creation, not taxes, not bond sales, not interest rates, not debt levels. The government readily admits to this “As the nation’s central bank, the Bank [of Canada] is the ultimate source of liquid funds to the Canadian financial system and has the power and operational ability to create Canadian-dollar liquidity [money] in unlimited amounts at any time.” and yet when funding is needed politicians will still do the where-do-we-get-the-money dance as if money were some scarce physical commodity instead of merely numbers in a computer. DON’T BE FOOLED! Everyone should care about our leaders lying to us in order to deny our collective needs.

How I got here

For some brief personal context, let me tell you how I came to be obsessed with the BoC and 1974. I got interested in monetary reform simply by learning about the system we live in and the nature of banks and money creation. It started with watching the first Zeitgeist movie (I’ve come SO far since then, as Zeitgeist is chock full of myths and inaccuracies too) and getting an interest in banking. Eventually that led me to the group the Committee on Monetary and Economic Reform, where I connected with the board.

But COMER’s co-founder William Krehm was quite old (he recently passed at 105); we no longer had his expertise to explain the intricacies of the monetary system, and a couple of the myths were being innocently propagated by COMER itself. I too had read the myths, on various sites and from various sources, and had eaten them up whole. But when sharing that information on various social media forums I kept getting called out, primarily by John Monroe, that my information was incorrect.

When John kept calling out the myth I would go into research mode and do my damnedest to prove him wrong and the myth right. But then a pattern emerged: the myth seemed to exist only on third party sites, many clearly of the conspiracy theory sort, I could not find any evidence of the claims on any official site. Now, that’s not to say it didn’t happen, 1974 was a long time ago and the government has only digitized so much from back then. More importantly, the BoC website did not go back nearly far enough in its monthly review or annual reports.

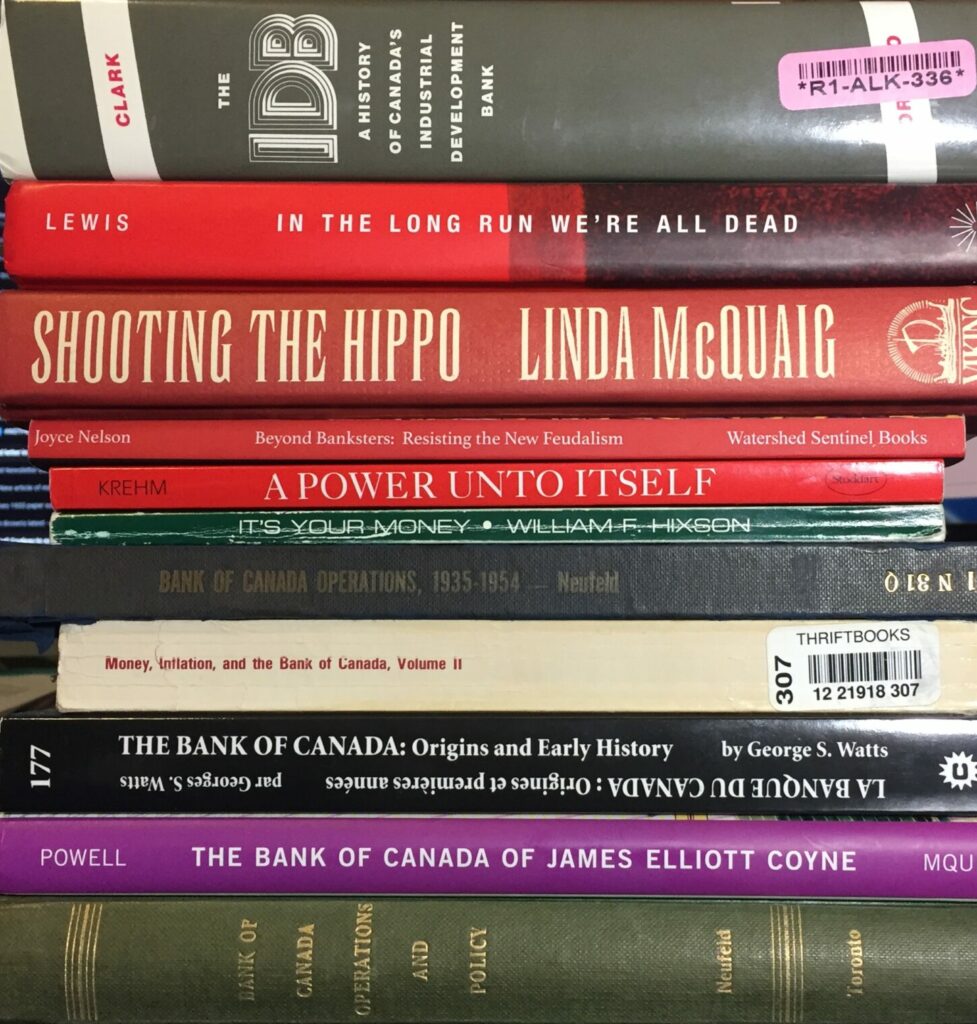

So began my years long quest for the truth about the BoC and 1974. I’ve bought nearly every book on the Bank of Canada in existence, some quite aged and dusty tomes, I’ve read the books of William Krehm, I’ve read many technical papers on the BoC website, but in the end the only way to dig right into that era was to go to the Toronto Reference Library and unearth the old Bank of Canada Reviews and Annual Reports from the 70s into the early 80s (digitized copies here). And boy does it tell a tale. I’m going to pick the myth apart piece by piece in sections.

Before moving any further, in case some people reading this are uninitiated, there are some realities of the banking system I need to put out there if you are to understand why lately there’s so much talk of monetary reform, MMT, sovereign money, and public banking, and why it’s perhaps the most important issue facing the entire global economy.

The basics of the monetary system:

The biggest hurdle to understanding the monetary system in Canada is that NOWHERE in Bank of Canada literature is it clearly spelled out. It gives the broad strokes, but anyone trying to dig to the heart of the accounting will be stymied at every turn. Unlike the Bank of England, which has no problem publishing a paper that is quite candid on the realities of the monetary system, the BoC seems to prefer being a black box, and past literature about the BoC gives the impression they like it this way, because it’s hard to criticize something if you’re unsure what exactly is going on. Luckily our system is very similar to the BoE, and third party books about the BoC reveal more than they do.

If you’ve never read anything about the monetary system in Canada the best place to start is right here.

https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201551E

It’s a short read, but the gist of it is, the vast majority of the money supply in Canada is created when private banks make loans. Yes, whether a credit card, business loan, line of credit, or mortgage, when that bank gives you that money it is not the savings of other depositors, it is not the bank’s money, it is not some percentage of some commodity like gold or a percentage of central bank reserves, it is simply numbers typed into a computer and PRESTO, new digital money you can spend. Almost all the money in the economy started as a loan. And as strange as it may sound to those unfamiliar with how money is created, just as extending a loan creates money out of thin air, paying back a loan destroys money, it disappears into that same air from whence it came! All that is left is the interest paid to the bank.

The power to create de facto money at will puts private banks at the center of the economy. If money is the lifeblood of the economy, banks are the heart pumping it through. History is replete with instances of this immense power being abused by fraudsters, and Canada is no exception. Even in the current era of relative stability and lack of fraud, the power wielded by our banks gives them both economic and political clout and the ability to ensure the economy remains a wealth vacuum for the elite.

I don’t want to delve into the intricacies of the monetary system, while this paper gets into some technical details, mostly it is debunking the history of what actually happened, so you can enjoy the paper without being intimately knowledgeable of the monetary system. But there is some basic terminology I should probably give context.

Other than physical notes and coins, most money exists digitally, just numbers in a computer, deposited in a bank somewhere. So, when speaking of money in a bank we refer to it as “deposits”. Anytime this paper mentions deposits or the creation of deposits, “deposit” is synonymous with “money”.

But the complexities of defining money don’t stop there. There is also another type of money, money only used by the central bank and financial institutions to settle their transactions at the end of the day. This type of central bank money is called “reserves” or “settlement money”. Reserves are also money, but only used by the central bank and financial institutions (notes and coins count as reserves too, but we’re not going down that road). As one example of how bankspeak requires one to already understand certain aspects of the system in order to decipher central bank literature, reserves/settlement money is mostly referred to as “cash” by banks and the government, even though they aren’t referring to physical notes.

If you find this supremely confusing you are not alone, it’s designed complex on purpose so that regular people don’t attempt to understand it and don’t realize the simple truth of banks’ money creation powers. As economist John Kenneth Galbraith said in his treatise on money:

“The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.”

From “Money: Whence it Came, Where it Went”, 1975 by J.K. Galbraith

Truer words were never spoken…

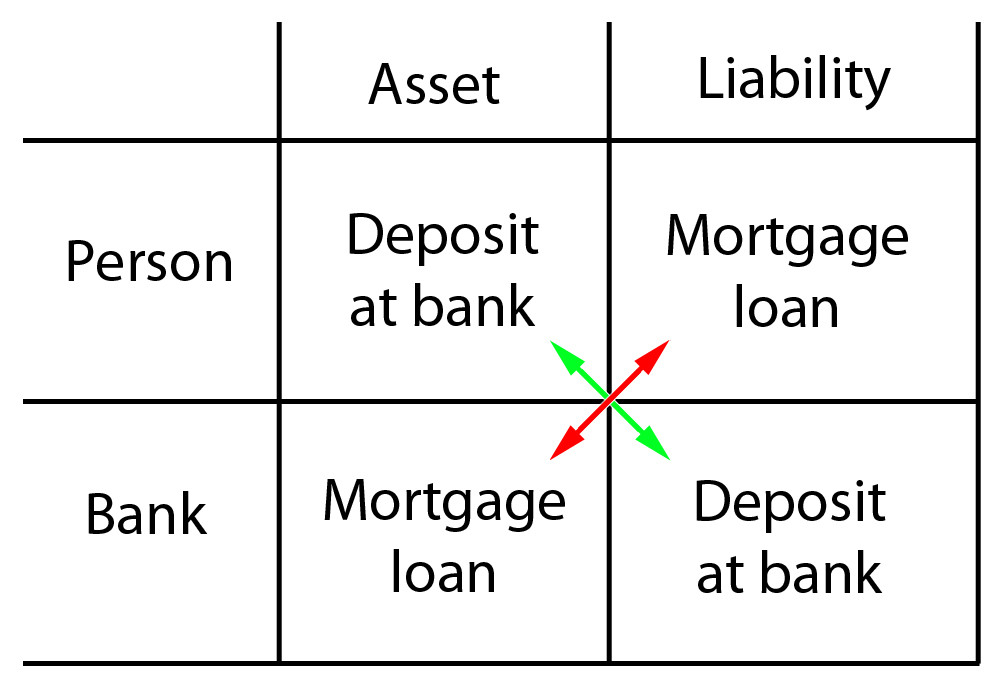

The other important concept to understand is the balance sheet. When you get right down to the nuts and bolts, the monetary system is merely accounting, it’s just two sides of a ledger. The balance sheet is always divided into two parts: assets and liabilities. Assets are what you own, liabilities are what you owe. Your house would be an asset, your mortgage is a liability. ALL of the financial world is divided thus, and being part of that world means we are too; as agents in the economic system we are each a walking balance sheet of assets and liabilities. Here’s the only tricky part to keep in mind: in terms of your finances, your assets are your bank’s liabilities and vice versa. Here’s a diagram to illustrate the point:

Because your deposit is something the bank owes to you, it is your asset and it is the bank’s liability. Likewise, as you owe your mortgage to the bank, it is the bank’s asset and your liability. The important thing to remember is the definition (assets = own, liabilities = owe), so you don’t want your liabilities to outweigh your assets, otherwise you are in the red and not financially healthy.

Lastly, one should understand what is meant by “inflation”, however most of the public are already familiar with this concept. It is the (usually) gradual devaluing of money. A dollar in 2019 does not have the purchasing power of a dollar in 1935: that is inflation. And it is the primary concern of central banks around the world.

All of the preceding chapter is really meant to illustrate one thing only: money is imaginary and there is absolutely nothing limiting the government from creating as much as the public needs other than an ideological choice. To say we don’t have enough money is to say we don’t have enough imagination, or as another reformer put it, “worrying about where to get the money is like having a conversation and worrying about running out of words”. The ONLY limits to the economy outside of nature itself are people and resources, any other arbitrary limit, like money, is self-imposed.

The MYTH:

Let’s start with the myth itself, it varies from place to place but the overall gist goes something like this:

“In 1974, at the behest of the Bank for International Settlements, the Rothschilds, and foreign banking interests (1), without debate in Parliament Pierre Trudeau ordered the Bank of Canada (2) (in some incarnations the myth claims the BoC was sold to the former interests) to stop lending interest-free to the government for public works and to start borrowing at compound interest exclusively from private banks (3), and because of that you can clearly see our public debt skyrocket on a chart (4). This history has been covered up by the government, as they also ordered the media not to cover the Bank of Canada lawsuit by COMER. (5)”

Well, if you believe any part of that, regardless of which parts you combine, you will be disappointed to learn that it is 100% false. There is not a shred of truth to ANY part of that statement. There are some things that could be considered distortions or confused history, but make no mistake, it’s all false. And I’m going to prove it once and for all to put all the misinformation to rest.

The BIS, Rothschilds, and foreign bankers:

The first part of the contention is that we made some change at the behest of one or all of the following: the Bank for International Settlements (BIS), the Rothschilds, and/or foreign banks. In some variations we even sold the BoC to private banks and/or the Rothschilds. All incorrect, but some history seems to be confused.

In terms of being sold to the Rothschilds or other banks, wrong, the BoC has been 100% publicly owned since it was nationalized in 1938. In terms of being controlled by them, we’ll get to that in a moment.

Where the history may be getting confused is we did do something sort of significant with the BIS in 1974: we participated in the first Basel Committee resulting in the Concordat. But that had nothing to do with monetary policy, it was all about how to maintain the security and supervision of banks’ foreign establishments and ensure they are all operating under comparable standards. This is important because banking being what it is, a private for-profit business with the ability to create money, historically it naturally attracts scammers and psychopaths yearning for money and power. To our credit, the last couple decades Canada has become a shining example of a strong resilient financial system that weathered the storm of the ’08 crisis better than most and now imparts our banking system wisdom to other nations. Now, it’s still a system of structural inequality, but at least it’s one of the more stable and least corrupt.

Regarding the claim we have a “strong, resilient financial system”, a fellow reformer pointed to a report by David Macdonald of the CCPA that makes the bold claim our banks were not so strong and required bailing out during the Great Financial Crisis. That’s a topic that deserves its own post, but in short, never happened. Macdonald has misconstrued and misrepresented what occurred. Firstly, not a single one of our banks was insolvent, so by definition it was NOT a bailout, it was liquidity support because credit markets were drying up due to the failures in the US. Secondly, it was loans and asset swaps, the former having been paid back within two years, and the latter, buying CMHC-insured mortgage-backed securities from the banks, actually earned us a small profit. As we’ve seen with General Motors, or former banks Northland and CCB, in a bailout you’re not likely to get your money back, never mind make a profit. And none of the interventions came out of the budget or cost taxpayers a dime, it was all central bank actions. Macdonald makes a few other incorrect claims (like claiming our MBS were toxic like in the US, not so), but his report is still important for two things it reveals: our banks did need substantial government support, and that the BoC tried to keep it quiet.

None of that’s to say we aren’t following the same neoliberal policy prescriptions of the likes of the BIS, Rothschilds, and foreign banks, but it’s not because we are controlled by them, it’s because all the banksters are on the same team and have the same neoliberal indoctrination through their education. People don’t get into banking and finance with a view to reforming it, they get into it either because they love numbers and/or because they want to profit from it, and so they learn how the system works and conform to that. The reforms that have happened are always in favour of the banks, and they have pretty much written their own regulatory and legislative changes over the decades.

There is also an esoteric appeal for those who rise to prominence in finance, some seeming to get off on being included in the elite technocracy because of expertise in an arcane and difficult subject. I’ve seen interviews with such types and you can tell they really enjoy being an authority in an area where few have the knowledge to challenge them or their jargon, so they can lord their knowledge of an invented imaginary system over people, as only a high priest of finance can communicate with the money gods.

The indoctrination of the disciples of finance goes deeper than merely their education teaching them about the system as if it is some immutable process, based on mathematically and scientifically-determined best practices, guided by proven standards and regulated for the benefit of all, rather than the inequality engine and wealth vacuum for the psychopathic corporate elite it actually is.

Economics and monetary theory are not based on universal rules handed down by the gods nor did they emerge from the physical laws of nature or scientific study, they are an invention of man, no different than a game of Dungeons & Dragons. The supposed rules and structures of that system are based on psychopathic assumptions about human nature, creating specious technical justifications to maintain the supremacy and speculation of banks and the financial system within a supranational corporate oligarchy, in order to ensure a constant flow of wealth upward to the richest in society.

The financial acolytes and the general public are also indoctrinated to believe that the various gains of the modern world are somehow directly attributable to the neoliberal capitalist system, as if none of it were possible otherwise. As if the economic results were a calculated decision by the ideologically programmed machinery of the system itself, and not the sum decisions of actual living people. Completely untrue of course, and many finance workers actually believe they are contributing positively to society at large, unaware they are merely a cog in the wealth vacuum for the elite, but this is not the paper to get into that.

The BIS does advocate for the independence of central banks, as you can see in this statement:

“monetary policy autonomy may be at risk if the central bank can be obliged to lend to the government or provide it with implicit or explicit subsidies in other ways, for example by supporting the price of government debt.”

But that is a common and longstanding sentiment of bankers and central bankers, not some new notion applied only with the advent of neoliberalism in the 70s. You can go back in the parliamentary debates about Canadian central banking and see many expressions of that concern from the very get-go in 1935, because it is a valid concern. Technocrats are wary of the machinations of politicians more concerned with being re-elected than of the impacts of short-term beneficial economic policies that may lead to long-term imbalances.

However, from the inception of the BoC, it was understood that the policy of the central bank was the policy of the government, and that the two worked in concert to achieve the government’s goals.

“It was increasingly emphasized that there had to be perfect harmony between Bank of Canada policy and government policy. Not only was it a question of avoiding possible long-run conflicts in policy; it became steadily clearer that Bank policy had to be government policy at all times. The Governor of the Bank [Graham Towers] stated the principle that central banks’ monetary policy ‘must conform to the policy of their respective governments. No other conception of the situation is possible in this day and age, nor would any other state of affairs be desirable in view of the vital effects which monetary policy can have on the affairs of a country.'”

“Bank of Canada Operations, 1935-1954” 1955 by E. P. Neufeld

This paper is not refuting that the BoC used monetary policy more fulsomely to facilitate the fiscal goals of the government pre-1975, it is refuting that the practice was stopped abruptly in 1974 with the advent of some new policy or directive specifically designed to kneecap the ability of the BoC to finance government spending. Part of the myth springs from the valid provable history that the BoC did in fact willfully and openly support government fiscal policy with accommodating monetary policy, and that the BoC was not always so “independent”. However, examples of divergence between government and BoC policy emerged long before 1974 starting with the Coyne Affair in ’61, with disagreements over monetary policy so deep the government amended the BoC Act to give themselves ultimate authority on the matter.

After that the BoC’s independence wavered but ultimately moved in the direction of more independence, peaking with the inflation obsession of Governor Crow in the early 90s, where he defied all powers-that-be in dragging Canada into a home-grown recession. From there on neoliberalism was fully entrenched at both the central bank and the government, and central bank independence became irrelevant as both entities were subservient to a larger ideology that dictated their behaviour, the neoliberal ideology emanating from the BIS and its ilk.

There are other historical examples of developing countries abusing their money creation powers and causing economic turmoil (although sometimes it’s less the result of the internal effects and more from external powers punishing the nation, as we see in Venezuela right now). But the irony there is that currently, developing nations are not allowed to use the same kind of expansionary policies that built up a strong public sector in developed nations in the post-war period. Now they must rely on foreign loans burdened with neoliberal conditions of austerity, privatization, and corporate control.

There is the valid observation of the secrecy of the BIS however. Yes, their meetings are secret, central bankers only, but while the meetings are secret any policy originating from those meetings would still be fully public if a central bank tried to implement them. The BIS is also very strictly NO POLITICIANS allowed, so any notion that an elected official, especially one ranked as high as prime minister, would be allowed to set foot in the building is simply unthinkable. Nowhere in any history will you find any suggestion that the BoC changed something in 1974 at the behest of the BIS, as you will discover later, none of the changes that actually happened originated with them.

Without debate in Parliament Pierre Trudeau ordered the Bank of Canada:

Pierre Trudeau did no such thing. First of all, while the governor of the BoC and the finance minister regularly meet to discuss monetary matters, the finance minister does not give the governor their marching orders. They consult with one another, but the governor and the BoC are free to do as they feel necessary (the glorious independence of central banks). The governor also occasionally speaks in front of parliament to update them as well. If you go back in Hansard (the record of parliamentary debates) you’ll see some pretty embarrassing questions of the governor by MPs who clearly don’t understand the monetary system. If a conflict arises the finance minister can issue a directive to compel the governor (the clause installed in the BoC Act after the Coyne Affair), but that power has never been used.

More importantly though, the PM would not themselves be issuing any orders, it would be the finance minister. And no such directive was ever issued. If the PM were to ever start issuing orders to the BoC its autonomy would be threatened and Canada’s global economic neoliberal reputation would be in peril, likely devaluing the dollar and causing divestment from the country.

Due to the years of disagreement between the Diefenbaker government and Governor Coyne in the 50s leading to the Coyne Affair in 61, and low growth and inflationary concerns in the late 60s and early 70s culminating in the OPEC oil crisis in 1973, monetary policy was under a spotlight and was hotly debated in the House of Commons and Senate, it was no secret. They were all talking about it, especially grilling the governor in the House to ask, over and over, whether or not the BoC was pursuing a “tight money policy”.

The BoC also does absolutely nothing in secret, anyone claiming so has a gross misunderstanding of how central banks operate. They try to be as transparent and predictable as possible in order to foster stability and smooth sailing for the financial system, in particular money markets. Markets do not like surprise announcements and certainly don’t like overarching changes without any consultation. Rest assured the changes the BoC did make (albeit in 1975) were not remotely secret and were done with the full knowledge and collaboration with government.

There is an irony for those who rabidly blame Trudeau for the rise in debt, because in the light of history he was actually doing the best he could with the cards he’d been dealt.

To stop lending interest-free to the government for public works and start borrowing at compound interest exclusively from private banks:

This one has a few variations to unpack, but first lets get one big misconception cleared up. The government has ALWAYS sold bonds to the BoC and ALWAYS sold bonds to private banks, all that changed was the ratio, and that didn’t happen until 1982 (more on that later). It is important to say “sold bonds” rather than “borrowed the money” because bond purchases by private banks don’t actually technically fund government spending, like at all, that’s one of the neoliberal lies we’ve been told (wonks only, the classic MMT paper by Stephanie Kelton “Can Taxes and Bonds Finance Government Spending?”).

But there’s a more important distinction that needs to be made here, the difference between “loans” and “monetary financing”. A lot of people point to the BoC Act and claim the loan provisions prove that the BoC used to make loans and no longer does so. That’s a huge misinterpretation of the function of central banks and the purpose of the loan provisions in the Act.

The BoC has actually made very few loans to governments in its lifetime, I’ve gone back into the Canada Gazette to unearth EVERY instance of a loan to either a province or the feds.

As you can see, it’s a short list. This is because these loans aren’t meant as loans to cover deficits, fund services, or build infrastructure; they are loans to cover temporary unexpected budgetary shortfalls, which is why the loan provisions in the Act are so limited in amount and time frame for repayment. You could never use a loan due in one year to build a critical piece of infrastructure. As you will also note from the balance sheets, the loans did not exist for long, they were repaid quickly.

The co-founder of COMER William Krehm himself notes this distinction in his illuminating work “A Power Unto Itself: The Bank of Canada – The Threat to our Nation’s Economy”:

“Today the total revenues of the federal government amount to over $140 billion in round figures. This would permit the central bank to lend the federal government – under the terms of Article 18 of the Act – one third of $140 billion, or slightly more than $46 billion. Such loans would have to be repaid by the end of the first quarter of the subsequent fiscal year and would, by definition, be short-term bridge financing. But according to the Act, there is no limit on the amount of government bonds that the central bank can acquire, nor of bonds guaranteed by the federal or provincial governments. Thus, longer-term financing of capital projects could be raised through bond issues taken up in part or entirely by the central bank.”

From “A Power Unto Itself” 1993 by William Krehm

Right there Krehm distinguishes between the loan provisions of the Act being SHORT-TERM bridge financing insufficient for longer term capital projects, and then offers the monetary financing solution in the BoC purchasing bonds and holding them as long as needed.

It’s also false to claim the BoC made loans for infrastructure because it doesn’t extend loans to the government for a specific purpose, the money goes into the pot of the Receiver General’s account and it’s up to the government to spend it through fiscal policy. While we have established the BoC used monetary policy to facilitate the government’s fiscal policies, it does not mean the government literally tells the BoC it needs money for a piece of infrastructure and the BoC provides it. The BoC is not an infrastructure bank or development bank, it is a central bank, it is concerned with monetary policy, the money it creates for the government is not earmarked for some specific fiscal policy. Excepting WWII (war is ALWAYS the exception) the past actions of the BoC were much more indirect, one cannot draw a direct line between any monetary policy and fiscal spending, only the wider conclusion that generally speaking expansionary monetary policy supported the expansionary fiscal priorities of the government.

More to the point, a central bank is not a bank intended to regularly make loans, it is a “lender of last resort”, meaning only if funds cannot be procured in any other way does the central bank make a loan, whether to a bank, financial institution, or government. This is all part and parcel of the notion of central bank independence discussed earlier, the BoC is simply not intended to be a piggy bank for the government. While there are good reasons for this, they don’t really apply to a responsible government not in crisis in a developed country with a healthy amount of trade whose only reason for increasing monetary financing is to mitigate the (false) neoliberal perception of the burden of public debt charges on budgets.

However (there’s always a however in this confusing tangle of history and misinformation), there is a piece of valid history that possibly helped create confusion and conflate the BoC and infrastructure loans: Bill 143 the Municipal Improvements Assistance Act. Yes, once upon a time the feds were directly loaning to cities for infrastructure projects, and while this might explain where some people get their history confused, it doesn’t quite fit the myth for a few reasons. The loans were not interest-free (they were at 2%), the infrastructure was required to have user fees to repay the loan, the program ended long before 1974, but most importantly, a point I can’t stress enough, the loans came from the FEDS as fiscal policy, it appears on their books as a loan, not on the books of the BoC. But imagine a time when the feds actively worked with cities to build infrastructure without also requiring a portion of the funding to come from a P3.

So, what was the BoC doing more of in the past that helped fund our public works? Un-neutralized monetary financing! (I know, what the hell does that mean, right? This is yet another area where there is simply no way to convey these topics without wading into jargon) Monetary financing is when the central bank buys bonds directly from the government which then credits the government with new reserves (central bank settlement money) in its central bank account. This form of public money creation is described in the government page from the start of this paper.

The “un-neutralized” aspect is key, because there is no cost-free way to fund deficits as long as the BoC fully neutralizes its operations (more on this later). It can be considered a de facto “loan” because technically selling bonds is “borrowing”, but it is not subject to the loan limits of the BoC Act. It’s kind of a back door loan if you will, and never really needs to be repaid, the government could roll over the debt time and again with a new bond issue that matches the maturation of the previous issues (for the wonks, here’s one of a few great posts on the topic of “overt monetary financing” from MMT godfather Bill Mitchell).

This is also where the “interest-free” myth comes from. Monetary financing means the BoC “buys” government bonds, but the government must still pay interest on those bonds to the BoC, which then after costs gets returned to the government as the profits of the BoC (confusing I know, this is the strange dynamic when the government owns the bank that runs its business). This is why it is NEAR interest-free, but never entirely interest-free.

Monetary financing is like making a loan to yourself, such is the power of a federal government with a publicly-owned central bank and a sovereign currency, they can turn on the taps to create more money any time they please. The reason they don’t is multifaceted; firstly there are valid concerns about inflation if you heat up the economy too much (although in the modern context of oversupply and underemployment this does beg deeper reflection), there’s also the effect on trade from reactions of foreign economies if they feel a nation is unfairly subsidizing its people, but mostly it’s because more public spending does not further the interests of the wealthy elite. It must also be understood, whether selling bonds to the BoC or to private banks, the government does not put out different priced bonds depending who’s lending to them (in fact, that’s the whole neoliberal logic behind it, to ensure the central bank is paying market rates).

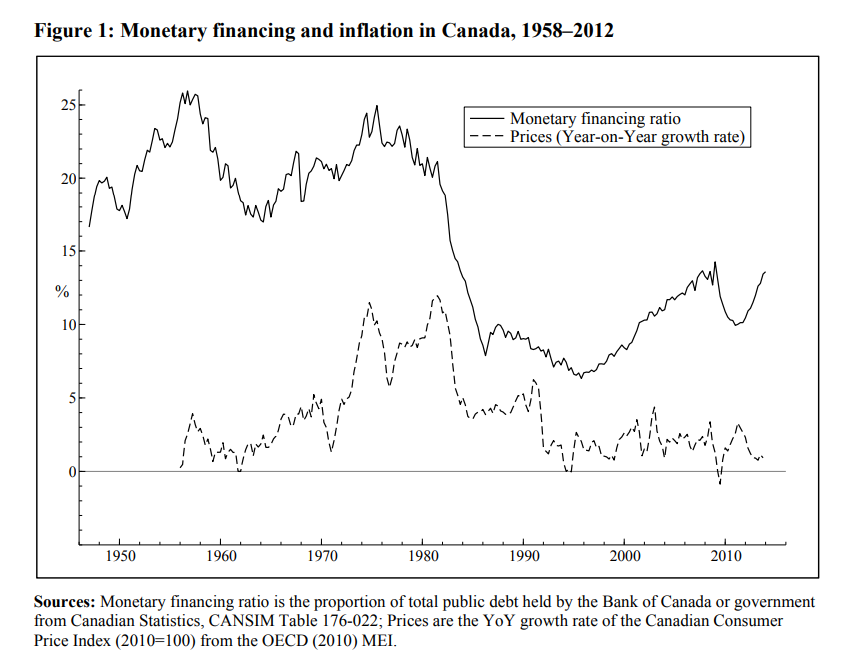

We currently do about 14% monetary financing, that is the percent of our total debt that the BoC holds, the rest is owed to investors of all stripes (we’re currently about 1/3 foreign owned). As mentioned previously, one of the prescriptions of the BIS is not to be funding government deficit spending through the central bank. However, this is one of the exceptional aspects of the BoC, we have always regularly had the BoC purchasing our bonds, it’s just part of its functions (other central banks, like the Fed or in the Eurozone, are strictly forbidden from directly buying the bonds of their governments).

The monetary financing we do currently is less about funding the government than it is about maintaining monetary policy; keeping a stock of bonds on hand to grease the wheels of money markets, and as an asset to match the liabilities of physical cash and the Receiver General account. But that monetary financing used to be higher pre-1982, peaking just over 25% some years, and that is the time Canada was building a lot of public works.

That is also the time we were using “un-neutralized” expansions in the money supply to accomplish the economic growth of the post-war period. That is what the Levy Institute paper “Is Monetary Financing Inflationary?” is all about. Because of the absurdly complicated way our monetary system is structured, when the central bank (on behalf of the government) spends money into the economy and people deposit those government cheques it creates new bank deposits, hence the money creation aspect. These new deposits become new liabilities of the private banks, so to balance out that increase in liabilities, the central bank simultaneously transfers a bunch of reserves to the private banks to increase their assets to match the increase in new deposit liabilities.

[Confused yet? Balance sheet descriptions do not fare well in verbal explanations, even static diagrams can be confusing. At some point (when I win the lottery I’ve never played?) I’ll include animations with these explanations, to truly show the magic of money creation.]

But banks do not like holding reserves, firstly, because reserves are central bank settlement money there’s little they can do with them other than lend their excess to other banks, and secondly, they earn the bare minimum of interest. This is also part of the reasoning the banks gave when lobbying successfully for the BoC to eliminate reserve requirements. So to accommodate the profit-hungry banks and maintain the target interest rate the BoC will “neutralize” (some central banks call it “sterilize”) the government spending by using transfers of government deposits and/or open market operations to swap those excess reserves for highly liquid risk-free government bonds, which are mostly used as general collateral in money markets to back loans, or can be traded for various other assets the banks choose to line their investment portfolios with.

Before we started paying interest on reserves, and when the BoC expanded the supply of reserves without neutralizing, we were in an era of cost-free public money creation (excepting the operational expense of running the BoC). Without swapping reserves for bonds the government could spend new money into the economy without paying interest to bond holders. But when we transitioned to a 0% reserve system between 1991 and 1994, we started paying interest on the reserves banks held, the Deposit Rate, so now, it doesn’t matter if we neutralize spending or not, whether it’s the interest on reserves or the interest on bonds, we pay interest to banks on every dime the government spends into the economy.

However un-neutralized monetary financing wasn’t the only trick in our central bank’s bag. The Ryan-Collins paper gets into the various other ways we used unconventional monetary policy to accomplish public works, including methods like encouraging banks to give loans to customers with which they would buy Victory Bonds to fund the war effort. A super roundabout way of doing it (this is why the Victory Bond issue ballooned so big it required the Conversion Loan of 1958), but nonetheless ensured war funding while preventing inflation by capturing savings.

The important thing to note is that there was more progressive use of the BoC, and it was more concerned with full employment, but to claim it was some kind of lending institution for public works is simply false, it’s a misunderstanding of how central banks work. Other than WWII, at no point would the government come to the BoC asking to loosen monetary policy for some specific project like infrastructure, it was overall just a different time with different attitudes and a very different economic environment of unprecedented growth.

Before we move on from the Ryan-Collins paper it’s important to note his choice of ending his analysis at 1975. While one cannot ignore the effects of the change to monetarism and other accompanying policies, it was not quite the sea change he makes it out to be. BoC levels of monetary financing remained steady until 1982, however pretty much everything else changed (raging unstoppable inflation, interest rates, focus of monetary policy, wage and price controls) so while it makes sense to end the analysis for those reasons, the point he is making about monetary financing being inflationary wouldn’t really end at 1975, but rather 1982, which also lends to the myth simply because of the year his paper ends.

The other problematic claim in this is the compound interest. While Canada has released bonds with compound interest (Real Return bonds) they are few and far between, the vast majority of our public debt is bonds and treasury bills (t-bills) and neither have compound interest, which is why they are called “fixed-interest securities”. A bond has a “coupon”, a set amount of simple interest that it pays out, either over time or at maturity. A t-bill is sold at a discount, and at maturity the full value is paid back, the difference being the interest. An investor might speak of these things as compounding if in their portfolio they use incoming dividends to automatically purchase new bonds, expanding their stock and the interest paid on them exponentially, but that’s not the same as the bonds or t-bills actually paying compounding interest. Other factors like inflation and interest rates can give the sum result of compounding debt, but that’s not the same as the interest on the debt being compound.

As for selling bonds to private banks and investors, we’ve ALWAYS done that, I don’t know there was ever a time in modern history where the government of Canada wasn’t selling bonds and paying interest on them. And we never completely stopped selling bonds to ourselves and only sold to banks. To reiterate, we’ve always sold bonds to the BoC and always sold bonds to banks, what changed was the monetary financing ratio, how much we sold to the former compared to the latter.

So, the notion that in the past we used interest-free loans from the BoC to build infrastructure is incorrect on a few levels. What we did do in the past was higher levels of un-neutralized monetary financing during a time of building alot of public infrastructure, but that was going on all over the world in the post-war boom. It was a progressive time of blossoming Keynesianism and explosive (and ultimately unsustainable) growth.

Because of that you can clearly see our public debt skyrocket on a chart:

The most annoying part about this claim is that it’s like people look at the chart of Canada’s public debt (unadjusted for inflation I might add), see the rise after 1974, and rather than find out what was happening in history at that time they just assume it is entirely attributed to some change in policy of the government and/or the BoC. It’s like other than looking at a two-dimensional chart they feel absolutely no deeper historical context is required to understand how such an astronomical rise in debt occurred.

The casino of financial market speculation reached an all time high at the end of the 20s, resulting in a stupendous crash in 1929. The following Great Depression kicked everyone’s asses, and that’s when in 1935 the newly minted BoC first got its chance to shine. It created tens of millions of dollars out of thin air both for the government and to capitalize the Industrial Development Bank (now the BDC) to make loans to small and medium-sized businesses, pulling us out of the Depression and ending the work camps. We nationalized the BoC in 1938, then we used our money creation powers again to help fund WWII, from which came the famous question and answer from the first BoC Governor Graham Towers’ testimony before the Standing Committee on Banking and Commerce:

“Q. Would you admit that anything physically possible and desirable, can be made financially possible?

Mr. Towers: Certainly.”

[It should be noted, for those who choose to follow the link to more of Mr. Towers’ testimony, that he very plainly explains the reality of our debt-based monetary system in which banks issue de facto money.]

After the horrors of WWII it was peace and time to repopulate. Enter the baby boomers and the unprecedented economic growth of the post-war period. Canadians were popping out babies by the literal dozen, and the need for employment and new housing and infrastructure for these expanding populations was driving growth in every way. Populations were growing, profits were growing, wages were growing, unions and organized labour were growing, and things were still very affordable. As the early boomers aged new hospitals and high schools were built, and then new universities. But with all that growth, inflation grew as well.

Monetary systems and monetary policy are very much a constantly evolving experiment, ours was still in its early teens in the post-war period, and a money market was almost non-existent. Through the 50s the BoC actively pursued developing a domestic money market, dealt with the Conversion Loan of 1958 when massive issues of Victory Bonds were coming due, in addition to finding its place in a non-Depression non-WWII economy of unprecedented and therefore unpredictable growth.

As globalization was a relatively new phenomenon, and nations were still finding their footing in this new peacetime economy of massive growth, throughout the 50s and 60s there were alot of swings of short recessions and booms. Unlike the last 40 years where most recessions and booms are entirely driven by speculation in the global casino of financial markets, in those days the real economy drove such things through actual fluctuations in supply and demand for physical materials and the resulting price swings in commodities.

The rapid growth started to hit the limits of the productive capacity of the economy, and inflation started to become a creeping concern. Interestingly, this was also a more progressive time, when equality, both of income and quality of life, was much higher, union participation was greater, and the top marginal income tax rate was over 90%. Once upon a time taxes were another tool to fight inflation, by removing money from the economy instead of merely making new money more expensive via interest rates, a use for taxes that has fallen by the wayside. Alas, the corporations love their profits and every government loves to brag about growth and employment, so they kept the economy running full steam ahead.

Hit the early 60s and Canadians are seeing inflation creep up and interest rates get higher than ever in history and they’re not comfortable (people were outraged when rates first topped 4%, if they only knew what was to come decades later). The Coyne Affair was super public and monetary policy is center stage, eventually leading to the Porter Commission and the clause in the BoC Act allowing the finance minister to issue a directive to the governor should a disagreement arise.

In 1962, due to the Diefenbaker government’s mishandling of their public spat with Coyne (you don’t mess with a central banker without consequences from financial markets), the dollar was spiraling downward, and we had to go begging to the IMF, Fed, and BoE for $1 billion in funds to stabilize the dollar. Governor Crow theorized that perhaps under Governor Rasminsky’s leadership the BoC would have done more about inflation in the late 60s and early 70s were it not so chastened from the highly public Coyne Affair. But of course Crow’s obsessive quest to combat inflation in the 90s involved cranking interest rates to historically punishing highs no matter how much deeper it drove our recession.

As inflation started to become a noticeable phenomenon, wage contracts, especially from public sector unions, started to be tied to inflation. In fact, the late 60s and early 70s were chock full of strikes and labour turmoil, as the labour force truly flexed its muscles more than any other time in history to get a greater share of the spoils of their labour. At one point Canada had a longer yearly labour stoppage than any other developed nation. This was all well and good while inflation was in the low singles, but then BAM: OPEC oil crisis.

This is the part that really baffles me when people talk about 1974. An exponential jump in debt starts to ramp up after that and no one bothers to mention that in 1973 a decades-long global inflationary event kicked off, changing the course of economies the world ’round? What’s worse, one day I suddenly asked myself, “what was happening to the public debt of other Western nations after 1974?” and when I looked it up, lo and behold, nearly identical rises in debt in all of them, it’s not unique to Canada. This means the phenomenon was inherent to the central banking system reacting to exogenous inflation; it’s just a symptom of the way it’s structured and constrained and how that structure reacted to the inflation of the oil crisis (debt-fueled deficit spending), it wasn’t some specific change in policy they all did in concert.

So OPEC takes revenge against US foreign policy by punishing the entire world and choking off oil supply, sending the price of oil into the stratosphere. While Canada is a bit more buffered to weather the storm from our own oil supply, being as dependent on imports as we are, there is no escaping the resulting inflation.

This all coincided with an environment of stagnant growth and persistent high unemployment, resulting in the combination of inflation and stagnation known as “stagflation”. One must also add that due to the gains of the Keynesian post-war period, both business and the public had expectations that economic wellbeing was a direct result of government action, and that ongoing government deficits were a perfectly acceptable reaction to stagflation, especially in combating unemployment (this was before the deficit hysteria of the 80s began in earnest). The oil crisis was an exogenous external inflationary event that was the catalyst for our own endogenous homegrown inflationary wage-price spiral triggered when the inflation clauses in those domestic labour wage contracts kicked in. Stagnant growth reduced federal revenues, which required deficit spending to prevent further recession, but inflation and rising interest rates caused deficits to rise exponentially, and the wage contracts tied to inflation ensured many unionized workers in the public sector were getting raises with the inflation, so the deficit grew even faster. And there begins a two decade journey to “lick inflation”.

This history has been covered up by the government, as they also ordered the media not to cover the Bank of Canada lawsuit by COMER:

As I hope I’ve thoroughly proven, there is no cover up, the history just wasn’t readily available. And why would it be? It’s exceptionally boring to just about everyone who isn’t a monetary reformer. Even people in banking and finance care not, they are interested in how the system works currently, they are not interested in going back to past practices we have evolved beyond. The government is only going to digitize so much of our old documents, digging into the BoC Review or Annual Reports is simply not of wide public interest.

In 2010 COMER decided to take action and bring the BoC to court for (in their minds) abrogating its duty “generally to promote the economic and financial welfare of Canada”. The main point of the lawsuit was to get the BoC to make loans to the government instead of borrowing from the banks, so we could return to our golden days of building public infrastructure with low-cost federal money. Some people mistakenly point to the preamble of the BoC Act, unchanged since its inception, as some kind of legal proof that the BoC is not living up to its purpose:

“WHEREAS it is desirable to establish a central bank in Canada to regulate credit and currency in the best interests of the economic life of the nation, to control and protect the external value of the national monetary unit and to mitigate by its influence fluctuations in the general level of production, trade, prices and employment, so far as may be possible within the scope of monetary action, and generally to promote the economic and financial welfare of Canada;”

That’s unhelpful for two reasons, firstly that a preamble is NOT law, just a general summary/introduction of a law, and secondly, it’s entirely subjective and open to interpretation. A single mother struggling on disability might not feel like the BoC is “regulating credit and currency in the best interests of the economic life of the nation” and “generally promoting the economic and financial welfare of Canada” but a CEO of a supranational corporation sure does. So any notion we can point to the preamble as a source of legal action can be disregarded.

While the lawsuit brought the issue of monetary reform to the forefront, getting a little mainstream media attention, uniting activists and progressive reformers across the globe (yes, we created a stir in monetary reform circles in other nations), it was always doomed to fail.

Much of the lawsuit hinged on the use of the word “may” in the BoC Act, as in “The Bank may make loans etc”, not that it shall. In the transcripts of the lawsuit, starting page 22 line 12, Mr. Galati makes a valiant attempt to paint the term “may” as mandatory rather than permissive and gives a few definitions of “may” and some examples to illustrate when it should be considered more than merely permissive. But it was always an incredible long shot, and when one considers the economic implications of legally forcing the hand of the central bank to offer loans to various levels of government, there was simply no way courts would ever have interpreted “may” as mandatory in a realm as complex and requiring flexible reactions as monetary policy.

Not only could COMER not legally force the hand of the BoC to take an action not prescribed by the law, but the article of the law they were saying should be used is not what we used to build our post-war infrastructure. The lawsuit focused on the loan provisions of the BoC Act, and as I’ve shown earlier, we were not using loans from the BoC to build infrastructure, it was just expansionary monetary financing in a quickly growing economy. So the lawsuit wasn’t even addressing the right policy action for the goal of more funding for public works.

As for a media cover-up of the lawsuit, well, Rocco Galati, lawyer for the lawsuit, seems to have concocted that fiction all on his own. After one of the court appearances he claimed in a video that he has it on good authority that the government has ordered the media not to report on it. While this was during the Harper years and one could be forgiven for believing Harper would attempt to shroud the issue in secrecy, no such thing happened.

At some point mid-lawsuit I was at a Why Should I Care? event in North York, the theme was about democracy and the media. An editor for the Toronto Star was there and I asked her about Galati’s claim. Well she said she’s never heard of anything so preposterous, the media do not take orders from the government on what to report (with the possible exception of the CBC). I asked her if she’d heard of the lawsuit, she had not a clue.

Not too long after that, within a year or so, two of our mainstream media sources covered the story. The Toronto Star did a piece, and the CBC took it one step further with an interview with Galati on the The Exchange with Amanda Lang.

One might argue Galati was right, and then the media wised up and finally reported it. Or, one could realize the more likely truth other than unfounded conspiracy theory: that the Bank of Canada lawsuit interests a ridiculously small minority of people and is simply not newsworthy in the minds of the public and media. And it simply isn’t newsworthy, outside of monetary reform circles I know of NO ONE that saw either article.

One could even argue the fact the Supreme Court refused to hear the lawsuit because use of the BoC is a political decision, not a legally prescribed process, proves it was a non-event unworthy of the news. Even my parents, avid and thorough daily readers of the Toronto Star, had not a clue about the article or the case. The topic is simply too esoteric and uninteresting for all but monetary reformers. Try talking about the monetary system to anyone who’s not in finance or a monetary reformer and watch their eyes glaze over in the first 30 seconds you’ve opened your mouth.

So what DID happen in 1974?

Well, other than the Basel Committee and trying to adjust to the inflationary storm post-oil crisis, not much. It’s 1975 where a change in policy happens: the BoC adopts monetarism and the Trudeau government adopts wage and price controls. In what is now known (in the esoteric annals of monetary history in Canada) as the Saskatoon Manifesto, in Oct 1975 Governor Bouey made the very public announcement of the switch to our version of monetarism called “monetary gradualism”, a suspiciously innocuous a name if ever there was one.

Before we get into monetarism however, it is prudent to illustrate a more fulsome context of the sociopolitical environment in the 70s, and to mention a few of the other variables contributing to the complex sum of human activity we call the “economy”. Keynesianism had done wonders for the post-WWII developed world, and the unprecedented growth was addictive to the corporate sector, but as mentioned, it left expectations very high in a time where deficits were not yet demonized.

Public and business expectations for government economic intervention aside, there were other changes that contributed to the environment of rising debt. As usual, in a lame attempt to stimulate growth and preserve profits (and appease the interests of Big Business), in the early 70s the government cut a few tax rates (personal, corporate, and the MST), which contributed to the deficit and resulting increase in debt. Along with monetarism NAIRU was gaining traction while Keynesianism was falling out of favour, exchange rates were unpredictable and often unkind to Canadian trade, and most importantly, as the lead-in to the OPEC crisis, was the collapse of Bretton Woods and the gold standard.

All of these variables and ideologies converged into a perfect storm of clueless fumbling about for solutions. The corporate profit experiment we call an economy was having a very existential crisis as the addictive unsustainable growth preceding the 70s had blinded politicians and business alike to the reality, clear in retrospect, that the ongoing deficits were structural because of secular decline: the economy had permanently shifted into a lower gear.

Monetarism is the theory that inflation is very closely linked to the growth of the money supply, and that if you can control the growth of the money supply you can control inflation. I could get into all kinds of details of Canada’s pointless failed experiment, but suffice to say, both the BoC and the Fed’s experiments with monetarism proved it wrong on two fronts: inflation and the money supply actually have a very weak if any connection, and you can’t really control the money supply anyhow.

The monetary system has been designed for banks to be able to determine demand for credit and provide it as they see fit, and market forces and the mechanisms of the central bank’s actions in the monetary system will simply limit the profitability of providing too much credit, but it isn’t designed to actually stop it cold. Even with reserve requirements a central bank will never refuse to provide the needed reserves for banks to clear with each other (part of its lender-of-last-resort functions), it will just charge a premium for doing so. The ONLY check on banks’ lending is the profit they might lose for doing it too much.

I can’t remember if I concocted it myself or I heard someone on social media suggest it, but at one point I started to believe that maybe there was a connection between the adoption of monetarism and the BIS, that maybe at the same secret banker conference in 1974 where the Basel Committee happened, they also spoke of monetarism and promoted adopting it. So I start searching for “monetarism” in relation to the BoC, and in Hansard to see what MPs were saying about it.

[Brief side note, in the early 80s, as we prolonged the last gasp of monetarism, the champion of monetary reform challenging the assumptions and prescriptions of the flawed policies of the neoliberal monetary system was none other than a young Bob Rae as an NDP MP. I mean like bang-on amazing stuff, really blowing the bullshit of the system apart and questioning the very premises it’s based on. Truly heroic, what the hell happened?]

What I’m searching for is the roots of adopting monetarism in Canada, where did the idea come from and who might have influenced us to adopt it? Turns out it all begins with the growing global popularity of Milton Friedman and his 1963 contention “inflation is everywhere and always a monetary phenomenon”, thus plunging much of the world into an obsession with controlling the money supply in various ways to rein in runaway inflation. His theory that others evolved into NAIRU (the non-accelerating inflation rate of unemployment) also gained ground in that time, informing many decisions and views.

Starting around the late 60s proponents of Friedman’s flawed and now thoroughly disproven theory of monetarism started clamouring for it to be adopted by central banks. The BoC, BoE, and Fed all had pressure building from economists and the financial community. There’s a book I dug up at the Toronto Reference Library, the Standing Senate Committee on National Finance report from 1971. In it there are details about debates at the Senate Committee between monetarists and central bankers, and while the committee seemed swayed by both sides, when you look into the testimony you really do see how the central bankers already saw monetarism was a flawed theory. Despite its flaws and the imposition of “a discipline that was market-based, impersonal, and above the reach of social forces” the idea was being bandied about everywhere for years, from the BIS, IMF, and many other neoliberal monetarist groups that Bank of Canada representatives participated in. None the less, pressure built up as inflation rose, desperation set in, and monetarism seemed a viable option.

We voluntarily chose to adopt monetarism in 1975, while in 1976 the BoE was forced to adopt monetarism as a condition of a loan from the IMF, and the US came in last in 1979 under Volcker. I get the impression reading accounts from the BoC and BoE at that time that the adoption of monetarism wasn’t so much because they were confident it was the right prescription to cure inflation, but because it had basically become a financial market expectation and they were feeling pressure on all sides to conform. Clearly monetarism was the flavour of the month and Keynesianism had fallen out of favour.

“The interest in monetarism and the quantity theory is to be explained more by the fact that policy based on Keynesian theory, and concentrating on fiscal policy, has been an evident failure [than by a] full scale scientific testing of the relative strength of the two approaches.”

From “Monetary Theory and Monetary Policy” 1972 by Harry G. Johnson

Inflation expectations are a huge part of determining bond yields, which are intertwined with interest rates. Sometimes, or so the hope goes, you can dampen inflation merely by easing the expectation of inflation, so market participants stop acting as if the environment is inflationary. If adopting monetarism might settle inflationary concerns simply because the market is clamouring for it to be adopted, why not give it a go?

As I mentioned earlier, monetary policy and the monetary system are all a big evolving experiment, and there are many ways to skin a cat. Central banks and money markets tend to all work on the same principles across the world, but the structure and mechanisms in them vary in some interesting ways.

There are a few different ways one could attempt to control the money supply, and Canada’s version of monetarism didn’t involve directly controlling the supply of reserves in the system like the US did, but rather used interest rates to entice savers to move demand deposits into savings deposits, taking them out of the spendable money supply (for the initiated, the control of the money supply was attempted by trying to influence the growth of M1 by using interest rates to entice people to move money in and out of M2).

The idea was that if people are saving their money they’re not spending it, and the drop in demand and consumption would ease inflation. The “gradualist” part of our approach was to have an announced target band for the growth of the money supply, and every year the mid point of the band would be lower and the range of the band smaller, gradually limiting the growth of the money supply. There were a few flaws: in how the policy was determined and then applied, and how they measured the money supply and the results. Did it have the intended effect?

Well, it went horribly, inflation raged on, leading a decade later to the highest interest rates in history, peaking over 20%. As Governor Bouey said in 1982 after winding down monetarism, “We didn’t abandon monetary aggregates, they abandoned us.” And it doesn’t matter if Canada’s handling of monetarism was done poorly or not, it was a flawed theory and a failed experiment and history and evidence have borne this out unequivocally.

So, out of a desperate bid to control runaway inflation in 1975 we adopted the Hail Mary of monetarism and wage and price controls, both eventually failing miserably, as inflation keeps rising along with interest rates. Let me repeat that, as inflation keeps rising along with interest rates. Now it’s time for some graphs.

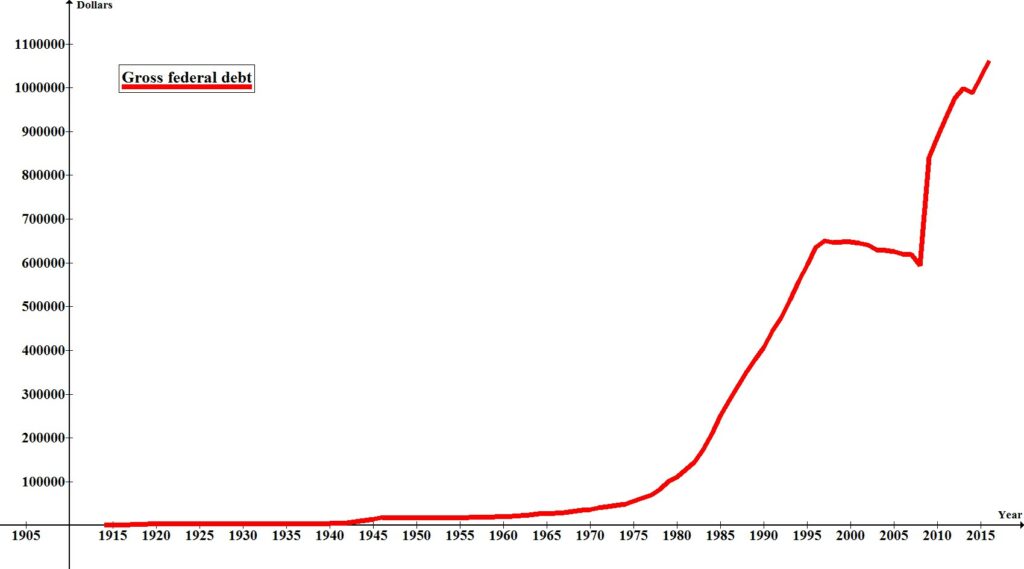

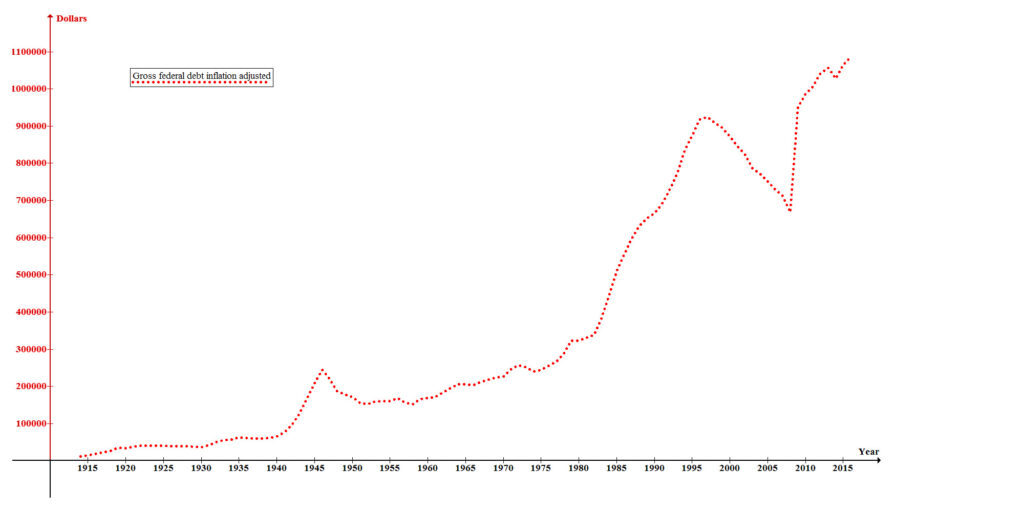

Here it is, the classic “hockey stick” graph of Canada’s public debt. Just look at that horrifying skyrocket after 1974 and drool over how steady and low it was prior to that. As one site full of falsehoods quipped, “something sure went horribly wrong after 1974!”

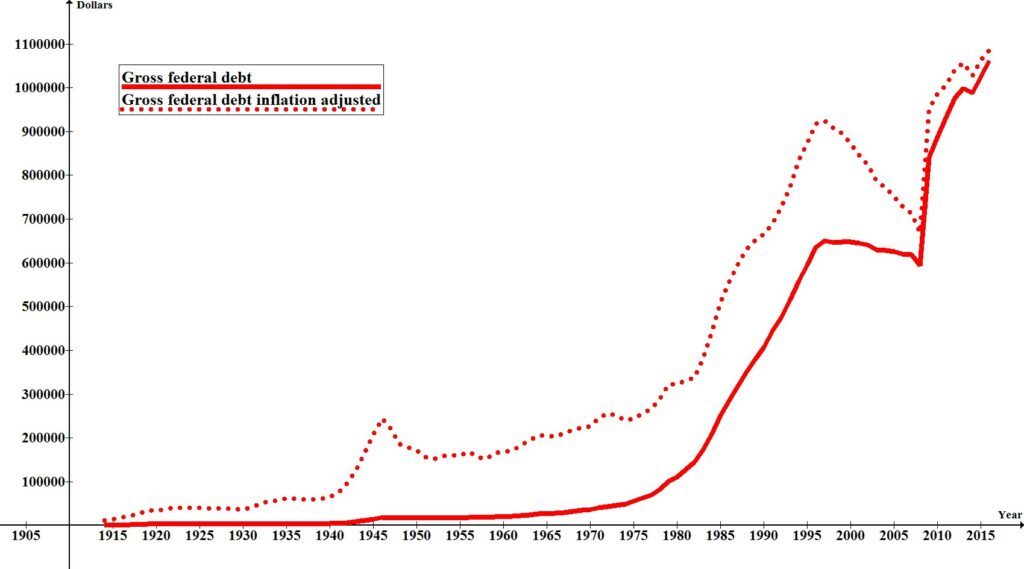

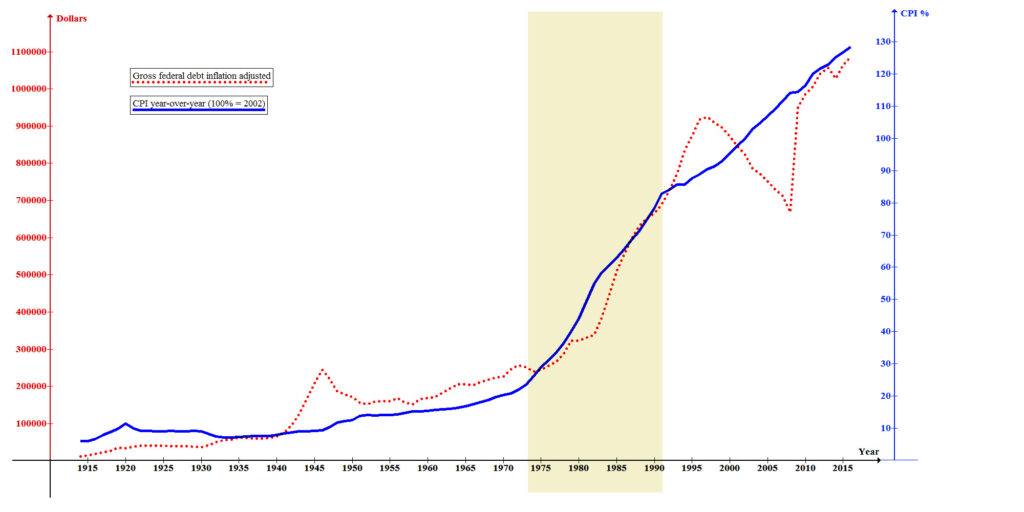

So the problem with this graph is that it’s not adjusted for inflation. You cannot compare money values across time, especially that long a time frame, without adjusting for inflation. It’s simply not accurate to compare a dollar in 2019 with a dollar in 1935. Here’s what it looks like in a proper context.

Suddenly WWII pops out in much more stark contrast, the climb immediately after 1974 is not quite as steep, and the true depth of the Chrétien economic shock therapy cuts of the 90s is revealed. This is the only way to honestly look at a chart of our public debt, otherwise you’re comparing money in times of different values.

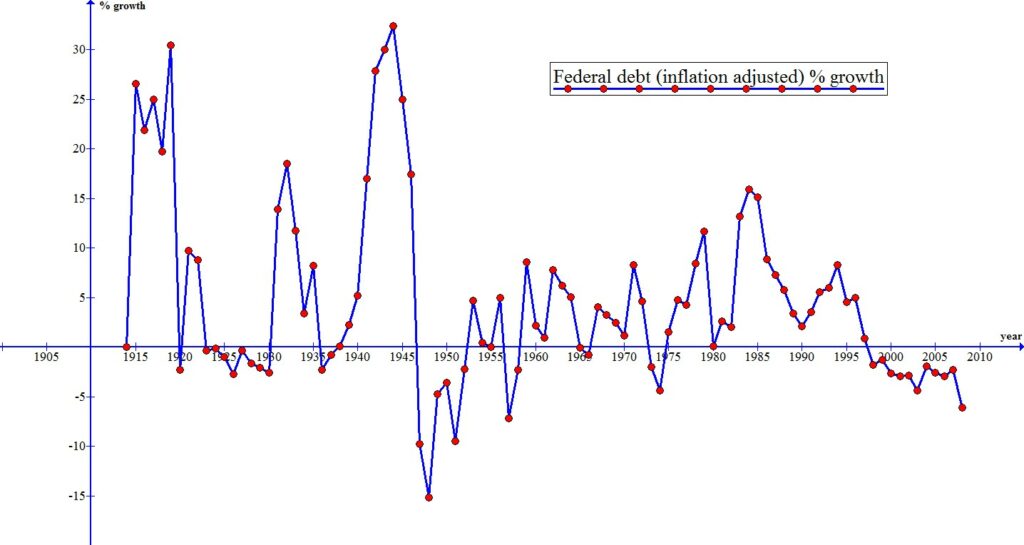

But there’s even more revealing ways to look at this information. We can look at the rate of the debt growth from year to year, to see when it was growing fastest:

When you view it this way you realize while there was significant growth in the 70s, it didn’t peak until mid-80s, which also coincides with the plunge in the monetary financing ratio featured in the Levy paper:

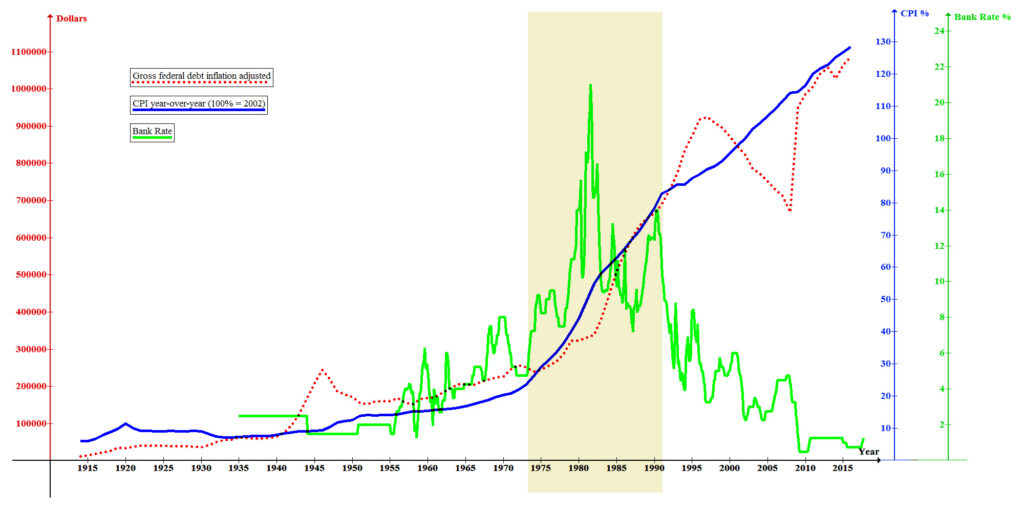

As you’ll soon see below, 1981 is when interest rates peaked over 20%. The question of what happened after 1982 is going to be the subject of another paper. Back to our debt…

So adjusting for inflation altered the graph a little, but there’s still a massive jump after 1974 to explain. Well, adjusting the graph for inflation doesn’t fully illustrate the relationship of the debt to the inflation. When you overlay inflation on the graph…

Well would you look at that, the inflation aligns almost perfectly with the rise in debt. Which makes sense, because ongoing high inflation would mean you’d need to sell more and more bonds every year because the money is worth less and less. But we’re not done quite yet, we haven’t considered interest rates.

Rising inflation means selling a greater quantity of bonds every year, but it’s also at a rate of interest, and when that is rising as well they compound each other into an exponential rise in debt. It is painfully obvious when you put the three on a graph and see how their peaks and slopes relate. The rise in debt was not caused by some change in the policy of the BoC, it can be explained simply by the combined effects of rising inflation and interest rates on bond sales.

Now, one can argue the change in policy was the increasing use of interest rates to dampen inflation and that would be fair, but one must also consider the interest rates of the US. One of the many ways we are more or less forced to react to the moves of the US is interest rates, ours never vary too greatly from theirs, especially in those days. So whether or not we felt 20% rates were obscene, that’s what the US was doing and we were forced to follow suit or watch capital take flight. This is also the reason interest rates must be higher than the rate of inflation, else the real rate of interest (interest minus inflation) would be negative and people losing money to inflation will move it elsewhere.

If one were able to accurately strip away both inflation and interest rates from the debt during that era one would find it grows at a much more normal pace with growth of the population and the economy. This is why the deficits have proven to be structural, not the result of new spending. The stagnation of growth was secular, a natural slowing that our economic and monetary system is ill-designed for and resulted in a so-called “corporate profitability crisis”.

Looking at the growth of government spending in various areas as a percentage of population without including ballooning interest payments on the inflating debt it becomes obvious the Trudeau Liberals were doing just enough deficit spending to keep on an even keel without worsening recession, they were not spending like drunken sailors burying Canada under a mountain of debt. They were doing the bare minimum to maintain a standard of living and not worsen unemployment while not unduly adding more to the debt. A 1981 report by Minister of Finance Allen MacEachen makes the case that the major share of deficit increases since 1974 were due to tax expenditures, all the tax reductions the Liberals were handing out in order to spur growth and placate Big Business. A keener from Stats Canada in the 80s, Hideo Mimoto, alarmed by the rhetoric about debt and deficits, also did a study (that got buried, but here’s a shortened version) supporting the same conclusion and adding that 70% of the rise in debt was due to mounting interest rates.

The irony of blaming Trudeau during this time, especially from those who claim collusion with the private banks, is that Trudeau was REVILED by Big Business for his meddling, especially the wage and price controls. There is no government action more despised by the corporate sector than one that interferes with the “free” market, especially if it controls wages or prices. More to the point, while the beginning of neoliberalism was definitely under Trudeau when we adopted monetarism, it was not until the Mulroney Conservatives took power that truly neoliberal attitudes started to dominate political discourse. Of course there’s a second irony in there, that the Chretien Liberals had to turn even more neoliberal than the Mulroney Conservatives to retake power and then really trash the government with deficit hysteria-fueled cuts to services.

There’s a great book on this history, “In The Long Run We’re All Dead” by Timothy Lewis. The subtitle is “The Canadian Turn to Fiscal Restraint” but it may as well be called “Canada’s Neoliberal Transformation”. Through keen analysis while trying to stay unbiased, Lewis deftly tracks the two decade transition from Keynesianism pre-1975 to pure neoliberalism post-1994. In it he makes the case about the various powerful forces at work in this transition, and both the valid and specious reasons for the transition.

Conclusions:

When it comes to understanding the history of the monetary system in Canada, 1974 is simply not the place to focus. To be sure the failed experiment of monetarism alongside wage and price controls starting in October 1975 is a relevant part of the history, but in terms of its effect on our debt or fiscal policy it is not terribly significant. However, the monumental stupidity of trying to control externally-caused inflation by constraining the money supply or raising interest rates cannot be stressed enough.

The notion that inflation is strictly a monetary phenomenon has been debunked, but it seems the equally specious notion that inflation is an excess of demand that can be controlled by interest rates persists. As this paper contends right from the outset, inflation is poorly understood, and its sources wide and varied and not always obvious. So to prescribe action that attempts to blindly and indirectly tackle inflation without ANY consideration of how that inflation came to be, not at all addressing the actual source of inflation, is pure folly.

Any honest central banker will admit that raising interest rates is meant to literally bring on a small recession to dampen demand. Apart from the fact it doesn’t address the source of inflation, there are numerous problems with using only interest rates to manage inflation, the biggest one being that whether you are low income or high income, or whether you live in an area full of jobs or suffering unemployment, we all get slapped with the same paddle. How does increasing the interest rate on a homeowner already halfway through their mortgage solve anything? They’ve already taken the loan a while ago, they’re not the “excess of demand” being targeted. The best metaphor would be chemotherapy or antibiotics, where the cure will also kill off a bunch of healthy cells in an attempt to expel the disease. But is the patient better off than before the cure, or are they left permanently weaker? Did the cure even target the disease, or does the doctor just prescribe whatever Big Pharma dictates (metaphorically speaking)?

Of the various experimental monetary prescriptions of neoliberalism, from monetarism, to reducing monetary financing, to single-mindedly obsessing over inflation with punishing interest rates, one of the most significant neoliberal evolutions of the BoC was the elimination of reserve requirements starting in 1991. Which is an idea that DID originate with the BIS.

Banks in Canada were complaining about competition from other non-bank lenders that were not subject to reserve requirements. Well, this is of course a bit of apples and oranges, because non-bank lenders (excluding credit unions) do not have the power to create credit, they do in fact lend deposits, or more accurately must fully match deposits to loans. But the banks “convinced” (over $20 martinis in a Bay Street steak house no doubt) the government they were being treated unfairly, that required reserves were like a “tax on their money”, and they should be free to spend and invest instead of having that ability curtailed by money that was dead to them held in reserve. Well they got their way, and now both the BoC and BoE are 0% reserve systems.

[WONKS ONLY: You can still conduct monetary policy in much the same way without required reserves, paying a deposit rate and charging the bank rate as the bottom and top of an operating band that constrains the cost of money. What this really meant is it truly spelled the end of cost-free government spending.]

In the end, as the title implies, 1974 and the Bank of Canada was much ado about nothing, at least as far as changes at the BoC goes. Yes a year later we changed to a policy of monetarism, yes we instituted wage and price controls, yes we started the trend of rising interest rates, but none of that confirms any of the mythology. The simple truth is this: